Key Insights

- Ethereum is going through a rough patch in terms of price.

- Despite these woes, whales have been observed selling, with one example selling at a $1 million loss.

- Tron Founder Justin Sun has also been selling via HTX, after spending the first half of last year accumulating.

- Ethereum appears likely to continue further downwards. However, a reversal could turn out to be explosive.

Ethereum’s price trajectory has been a hot topic in the crypto space, especially as the cryptocurrency struggles around $3,500.

This week, a flurry of whale sell-offs has left investors treading cautiously.

Let’s unpack what’s been up with these Ethereum big players, and what might happen with the second-largest cryptocurrency by market cap.

Whale Selloffs And A Million-Dollar Loss

According to on-chain data, Ethereum whales have been unloading their holdings.

The interesting part of this trend is now some of these whales have been selling at losses.

Just hours ago, three wallets—likely controlled by the same entity—sold 10,070 ETH for $33 million DAI.

This whale sold at an average price of $3,280 per ETH and took on a loss of more than $1 million.

According to insights from LookOnChain, this whale had withdrawn a total of 24,029 ETH—valued at $81.3 million—from Binance using 10 newly created wallets.

However, despite this sell off, the whale still holds 13,959 ETH (~$45.48 million) across these wallets.

Justin Sun’s Massive Ethereum Deposits

But it doesn’t stop there.

Another major development came from Tron founder Justin Sun, who has actively been moving Ethereum into HTX.

SpotOnChain notes that in the last 13 hours alone, Sun deposited $320.4 million worth of ETH into the exchange.

The Tron founder has also deposited a staggering 323,591 ETH—worth $1.124 billion at an average price of $3,472 since November of last year.

SpotOnChain notes that Sun’s activity came after a period of accumulation in the first half of the year.

He also purchased this ETH at an average price of $3,036 and is now selling slightly above break even with a current ETH price of $3120.

Ethereum Price Struggles Under Pressure

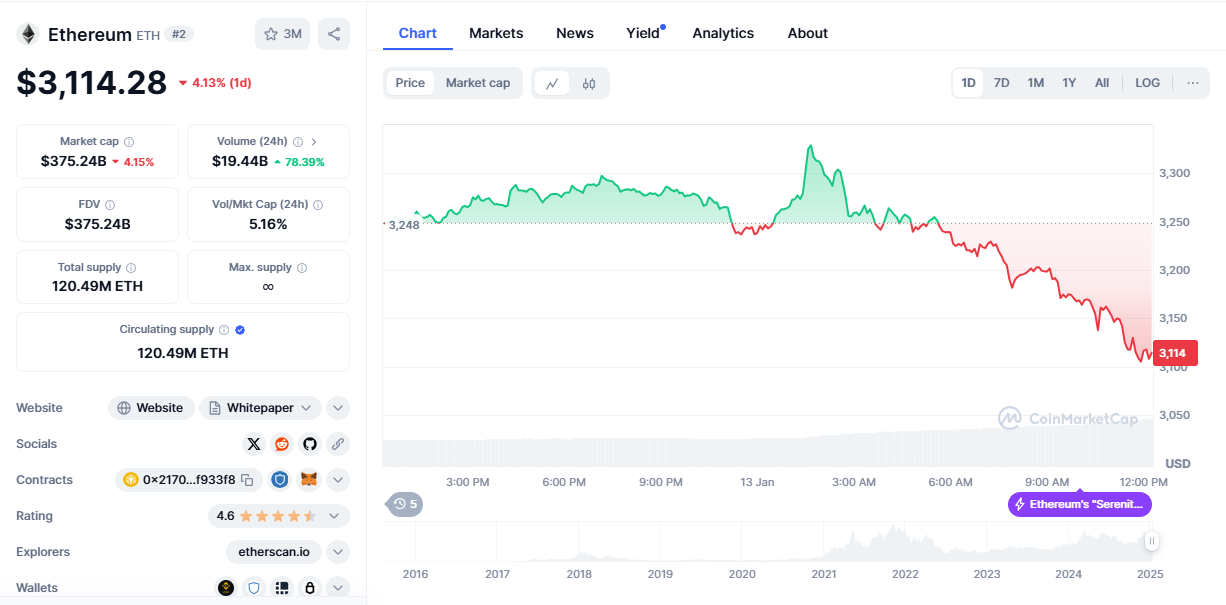

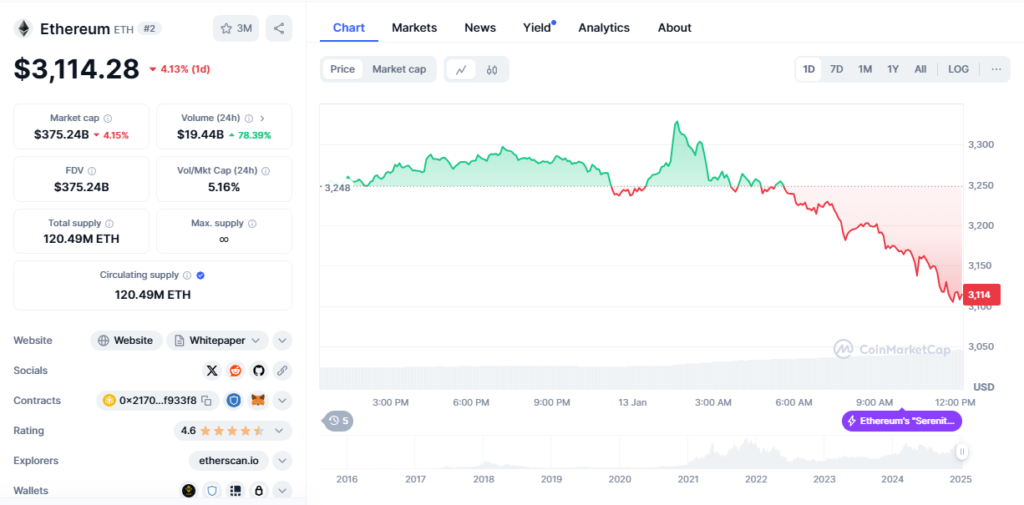

According to CoinMarketCap, Ethereum’s price is currently under downward pressure after dropping 4.15% in the last 24 hours.

According to popular crypto analyst Ali Martinez, a critical resistance zone currently sits between $3,360 and $3,450.

On the downside, the key support levels sit around $3,066 and $3,160—a price range that Ethereum needs to avoid breaking under.

According to the daily charts, Ethereum has been trading within a range between $4,143 and $2,124 since December of 2023.

This means that If the $3,066—$3,160 resistance breaks, Ethereum could be in for further correction towards the $2,100 zone.

In many ways, this could be a good thing. According to Ali in an earlier tweet, Ethereum revisiting the $2,800 zone could serve as a great launch pad for a rebound towards $6,000 or higher.

A Major Moment for Ethereum

Ethereum is currently at a crossroads at this point.

The whale sell offs, and resistances being broken present challenges for the cryptocurrency.

However, its long-term outlook remains promising, with analysts like Ali predicting $6,000 and MAXPAIN predicting an incoming rebound soon.

Investors and traders will need to do proper research and manage risk effectively to navigate Ethereum properly.

Overall, Ethereum’s performance in the coming months should set the stage for the next few years.