Key Insights

- Bitcoin attempted a break above the $100,000 price level after the CPI data release on Wednesday.

- The cryptocurrency is facing resistance from here and could consolidate for a while longer.

- Regulatory clarity is expected soon as Gary Gensler prepares to exit office.

- Donald Trump’s inauguration is also expected to bring in much friendlier crypto policies to the US.

- Ultimately, Bitcoin could break out and target the $125,000 price level.

The Bitcoin price today, crossed the $100,000 mark once again after the positive outcome of Wednesday’s Consumer Price Index (CPI) data.

This milestone has sparked investor confidence once again, considering the low it suffered when Bitcoin came close to crashing below $90,000.

Here’s what’s been up with Bitcoin and how it is likely to perform, going forward.

CPI Data and Market Sentiment

December’s CPI report revealed a rise to 2.9%. This was positive because it came in as slightly more than November’s 2.7%.

The core CPI (which excludes food and energy costs) also grew by 3.2% on a YoY basis, even though it fell short of the expected 3.3% increase.

These figures sparked market optimism, suggesting that the Federal Reserve might soon lower its interest rates.

This would be great for crypto in particular because lower interest rates typically drive investors toward risk assets.

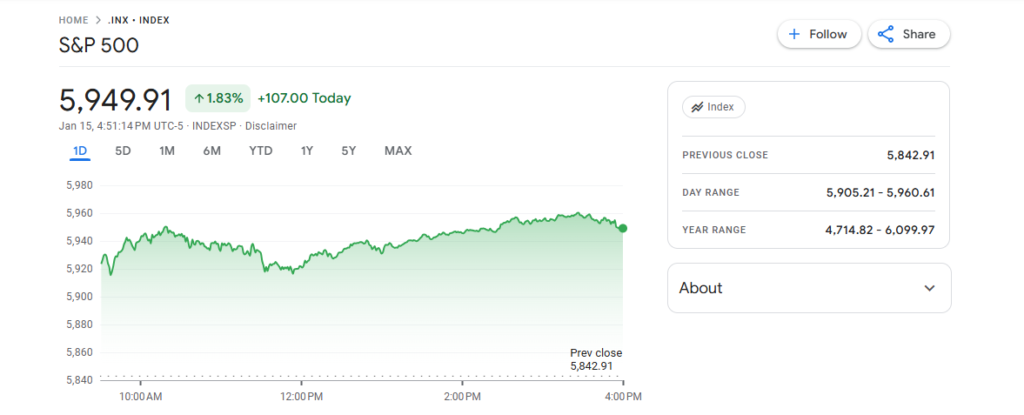

Bitcoin’s upward momentum also mirrored gains in the stock market, with the S&P for instance, rising by 1% after the CPI announcement.

Regulatory Clarity on the Horizon

Regulatory clarity is also showing signs of health.

According to a recent Reuters report, the Securities and Exchange Commission is preparing to revise its crypto policy under new leadership.

This replacement of former SEC Chief Gary Gensler is expected to bring much-needed clarity to the crypto industry.

Digital assets are expected to have more clear-cut definitions on what is and isn’t a security—one of the longest-standing demands from entities like Coinbase.

Interestingly, the outgoing SEC Chair Gary Gensler reiterated to Yahoo Finance that the existing laws are sufficient to regulate crypto.

Despite this, reports strongly suggest that the enforcement actions initiated under former president Joe Biden could be paused or revisited.

The Broader Market Gains

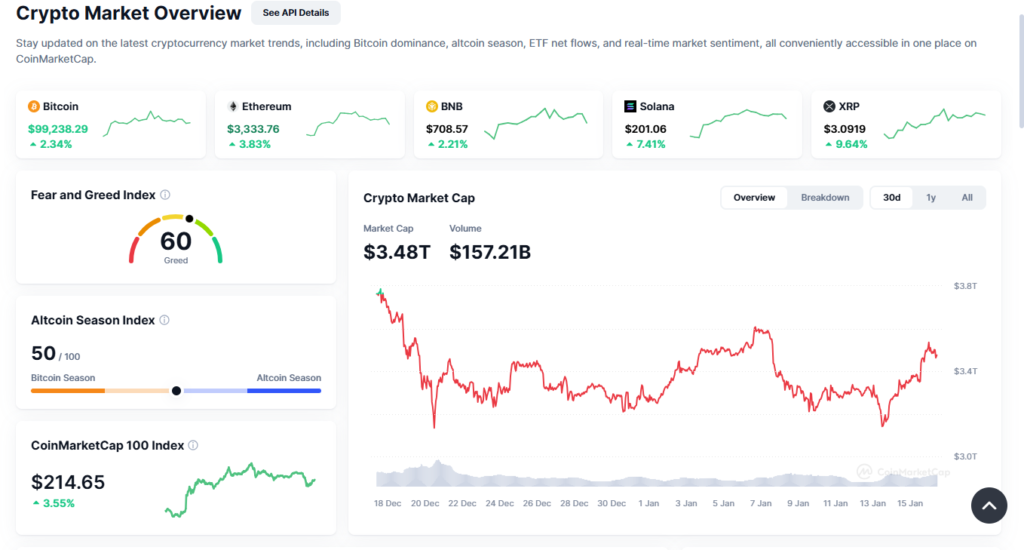

The crypto market’s total market cap exploded to the upside by $100 billion between Wednesday and Thursday, according to CoinMarketCap.

This also came with a broader recovery across the altcoin market, where several cryptos posted impressive gains.

For example, XRP and Stellar (XLM) jumped 14% and 15%, respectively. The same held true for Avalanche (AVAX), which climbed 9%.

The AI and meme coin sectors also gained significantly from this CPI event.

Tokens like Virtual Protocol and ai16z (both of which suffered intense bearish pressure during the week), soared 24% and 18% respectively.

Bitcoin Price Predictions—What Lies Ahead for Bitcoin?

Several factors are likely to shape the future of crypto in 2025, including factors like CPI data (as we saw on Wednesday) and interest rate cuts.

Donald Trump’s return to the presidency is also expected to bring in major changes for crypto and push prices higher.

Analysts expect that Bitcoin’s price could go as high as $169,046 in 2025. Bitcoin is also expected to hit a minimum of $85,000 during dips at any time.

Moreso on average, the price is expected to stabilize around $127,023 between March and June.

This optimism stems from the increasing rate of adoption by major countries like the US and El Salvador, as well as institutional interest in the Bitcoin ETFs.

Michael Saylor also continues to push for Bitcoin as a solution to the U.S. national debt.

He recently proposed that the government allocate 20–25% of its reserves to Bitcoin, to make the country the “economic capital of the digital world.”

Long-Term Bitcoin Price Forecast

Bitcoin’s price is expected to rise steadily in the coming years. This growth is expected to be supported by halvings and broader adoption.

According to insights from CoinCodex, Bitcoin will range between $111,156 – $192,907 and an average of $152,031 by 2026.

In terms of “Bitcoin price prediction 2030”, CoinCodex data shows that the cryptocurrency will range between $196,000 and $280,000.

According to the current charts though, the BTC price appears to be confined within a bullish pennant as shown.

Although Bitcoin has reversed from its $100,000 high, it is still in a consolidation and is likely to breakout towards the upside.

In case of a reversal continuation, the BTC price is expected to go no lower than the $90,000 level, before making another attempt at the $100,000 mark once again.

If a breakout occurs from this point, Bitcoin is likely to shoot upwards toward the $125,000 zone.