Key Insights:

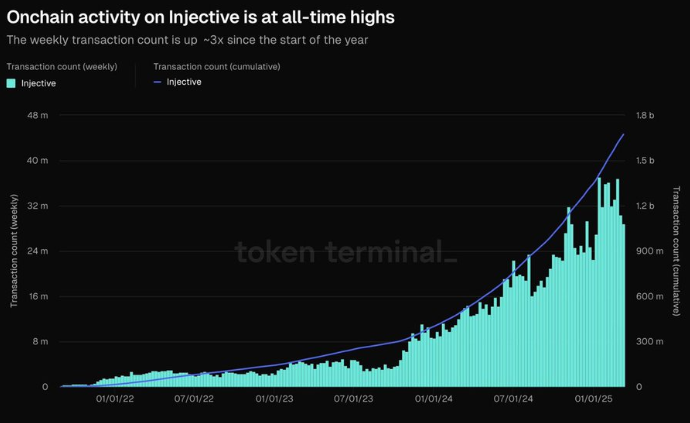

- INJ experiences a threefold increase in weekly transactions.

- A bullish cup and handle pattern signals a potential breakout.

- Key resistance at $10.8, a breakout could trigger a 30%-40% rally.

Following a significant downturn over 34% this month, Injective crypto price remained steady around the $10 mark and bounced off from the support zone of $8.

At press time, Injective price was trading at $9.76, noting an intraday decline of over 2.74%. Its market cap stood at $964.64 Million.

The question remains whether Injective crypto can retain its bullish momentum or succumb to resistance along the way.

Bullish Outlook Builds as On-Chain Activity Rises

Injective (INJ) crypto saw its on-chain activities skyrocket with an unprecedented growth phase.

The first weeks of 2025 witnessed explosive growth in weekly transaction volumes exceeding three times the numbers recorded earlier during the same year.

The platform achieved its maximum weekly transaction volume at 48 million executions which showed increasing user participation.

The increasing adoption of the platform will be substantial given the expected 1.2 billion cumulative transaction volume which should drive up INJ demand.

Rising platform engagement demonstrates a positive market trend for Injective Protocol because of strong user interaction.

INJ crypto benefits from rising market conditions because platform service pricing increases as demand grows among users.

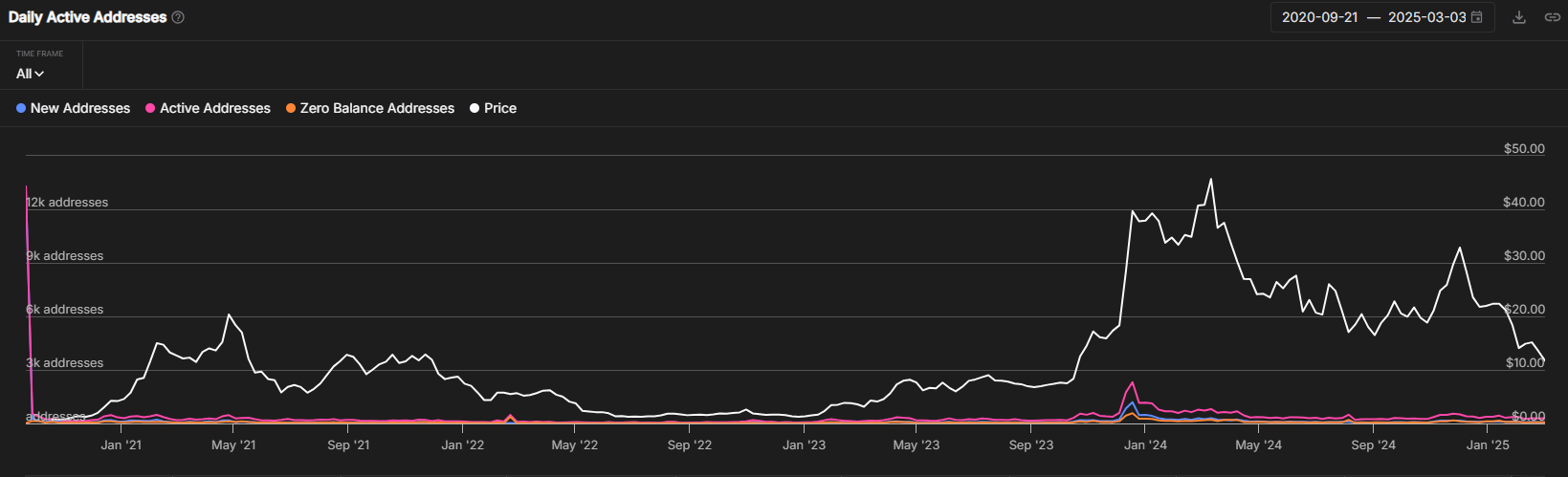

However, Injective’s ecosystem is experiencing significant decline, with a 38% drop in new addresses and a 12% drop in active addresses over the past week.

These metrics suggest decreased interest from market participants and lower engagement from existing users.

Injective Price Prediction: Key Levels to Watch

Analyst TedPillows in his recent post on X revealed that the Injective token formed a cup and handle pattern on the 4-hour timeframe.

This pattern is a bullish indicator which shows positive price direction coming from periods of consolidation.

Per the technical indicators readings, the RSI and MACD implies a bullish outlook. The Relative Strength Index line displayed a positive crossover, standing at 37 suggesting significant room for upward movement ahead.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator showcased a bullish crossover, hinting a bullish momentum on the charts.

Data from Coinglass showed that the Open Interest (OI) sheds over 0.63% to $82.19 Million in the past 24 hours. It revealed a sign of long unwinding activity which signals a caution among investors.

Also, the Long to Short Ratio (1D) stood at 0.9135 which shows the bears have maintained their upper hand and bulls need to close above the $10.80 mark to beat the bear army.

A close above the $10.80 mark could spark a 30-40% rally in the next few weeks.

Until the support level of $9.95 does not breach, Injective Protocol bullish thesis remains validate and a significant short covering move could be anticipated ahead.

However, if sellers succeed to break below the $9.90 mark, selling pressure could lead the token toward the $9 and $8.20 mark in the coming sessions.

The immediate resistance stood at $11 and $12 and breaking through these levels would confirm additional bullish signals.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Reza Khosravi brings sharp analytical insight to the world of cryptocurrency. With extensive experience in technology reporting, he focuses on translating complex crypto trends into accessible content for his audience, making him a trusted voice in Iran’s evolving digital economy.