Highlights

- Ethereum whales have withdrawn $240 million worth of ETH from Bybit, generating market buzz.

- ETH price currently hovers around $2,000, with supply on exchanges at its lowest since 2015.

- Market analyst CryptoGoos believes Ethereum is shaking off a bear trap, indicating potential for upward movement.

Ethereum whales have made headlines by withdrawing a substantial $240 million worth of ETH from Bybit. This significant move has generated buzz in the market, prompting speculation about its implications for the Ethereum price trajectory and long-term prospects.

Currently, the Ethereum price has reached the $2,000 mark, while on-chain data reveals that the supply of ETH crypto on exchanges has fallen to its lowest level in nearly a decade.

Market analysts interpret this trend as a sign of long-term accumulation, suggesting that investors are opting to hold their assets rather than sell. This behavior could indicate growing confidence in Ethereum's future, setting the stage for potential price appreciation.

Keep reading to know more.

Whales Move SIgnals An Incoming Rally Hints In Ethereum Price

Historically, when whales withdraw large amounts of Ethereum from exchange platforms, it often signals a trend of growing accumulation.

Recently, Whale Alert highlighted this activity in a post on X, revealing that Ethereum whales have withdrawn a significant $240 million worth of ETH crypto’s from the Bybit exchange.

This pattern of accumulation is typically seen as a positive indicator by market participants, as it suggests potential for favorable price trends in the future.

When the available supply of Ethereum decreases due to such withdrawals, it can lead to increased market demand, creating an environment that is conducive to rising prices.

Ethereum Price Optimism Rising As ETH Supply On EXchanges Are Lowest SInce 2015

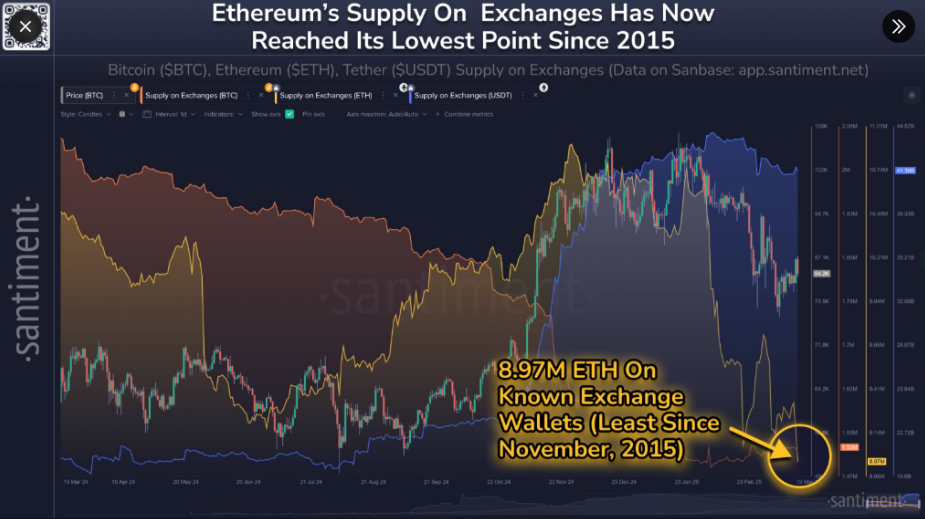

Data from Santiment reveals that the total amount of Ethereum available on exchanges has dropped to 8.97 million ETH, marking the lowest exchange supply since November 2015. Over the past seven weeks, there has been a notable 16.4% decline in ETH supply on exchanges.

This decrease often suggests that investors are moving their holdings into private wallets or opting for staking options. Such trends can alleviate selling pressure and positively influence the Ethereum price.

This shift aligns with the growing popularity of staking and decentralized finance (DeFi) products, as many ETH crypto holders choose to lock up their tokens rather than sell them.

Also, many are staking their ETH to earn rewards, contributing to the asset's supply reaching an all-time low in nearly a decade.

Additionally, crypto analyst Ali Charts weighed in on the situation, emphasizing the importance of the $2,000 mark for Ethereum. He noted that while this level is crucial, the overall outlook for potential price movement remains positive.

In a recent social media post, Ali advised traders to focus on the bigger picture rather than getting caught up in daily price fluctuations.

Analyst Said That Ethereum Price Is Waving Off The Bear Trap

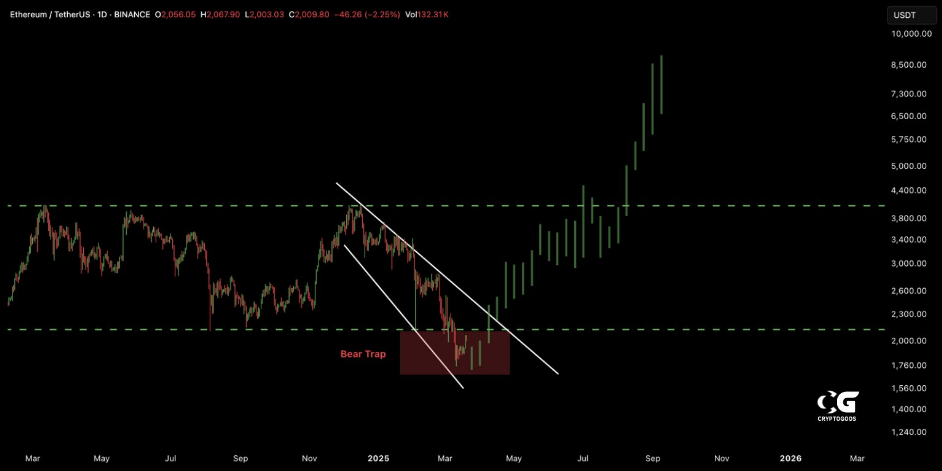

Moreover, the Ethereum price has struggled to maintain a solid footing above the $2,000 mark for some time. As of now, the token is trading at $1,978.63, reflecting a decline of approximately 1.55% over the past 24 hours.

The price has encountered resistance at the $2,050 level, and analysts are closely watching how Ethereum will react in this area, as it could determine whether a further drop occurs.

Market analyst CryptoGoos provided insights into the current price movement, suggesting that Ethereum is shaking off a bear trap and dismissing a bearish outlook. This indicates that some traders still have faith in ETH crypto's potential for an upward trajectory.

However, interest from institutional clients appears to be waning, even as the supply on exchanges continues to contract.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.