Key Insights:

- DOT price has broken out of a bullish falling wedge pattern, indicating a potential upside.

- $7.00 is the first major resistance, with $11.00 as the next target.

Polkadot (DOT) price action has grabbed the market's attention following a weekly price surge of over 4.3%. Despite the broader market headwinds, Polkadot crypto continued to showcase relative outperformance.

It has revealed a falling wedge pattern breakout and is set for a significant upswing. At press time, DOT price was trading at $4.49, reflecting an intraday gain of 0.78%. Its market capitalization has reached $7 Billion.

DOT Price Breakout Signals Strong Bullish Momentum Ahead

During recent sessions, Polkadot has been trading within a falling wedge pattern, typically a bullish reversal indicator. Despite this, it continues to underperform compared to the broader crypto market.

However, it has regained the bullish momentum and lifted over 20% in the past two weeks. Polkadot crypto has broken out of its falling wedge pattern, a positive sign for its price trajectory.

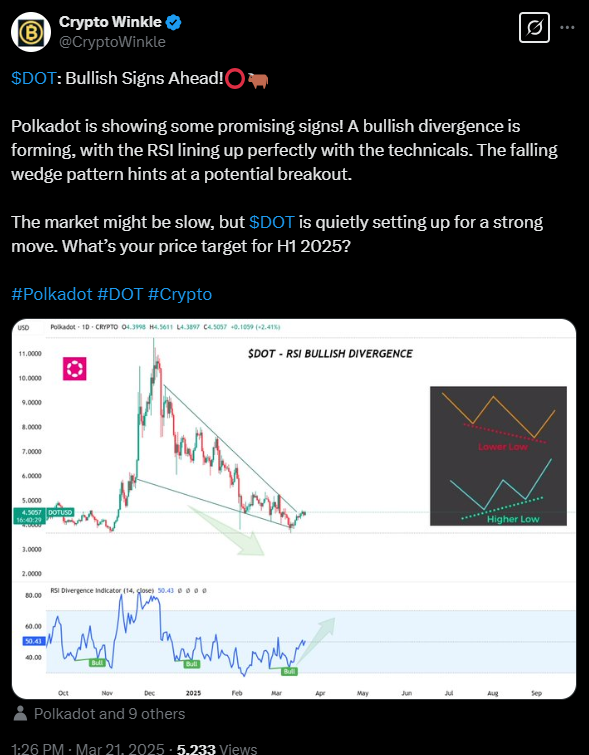

DOT price aims to surpass the $7 resistance and approach the $11 supply zone soon. A recent post by Crypto Winkle highlighted that the token has sparked signs of bullishness.

The daily timeframe analysis revealed a bullish divergence favoring the bullish thesis. The recent breakout hints at a potential rally next.

Amidst the sideways market, the ongoing breakout move might be slow. However, Polkadot crypto is setting up for a strong move.

It could trigger a significant reversal if the token sustains its bullish momentum beyond the $7 mark. This movement may set the stage for a rally toward its 52-week high trajectory.

Polkadot On-Chain Activity and Network Growth

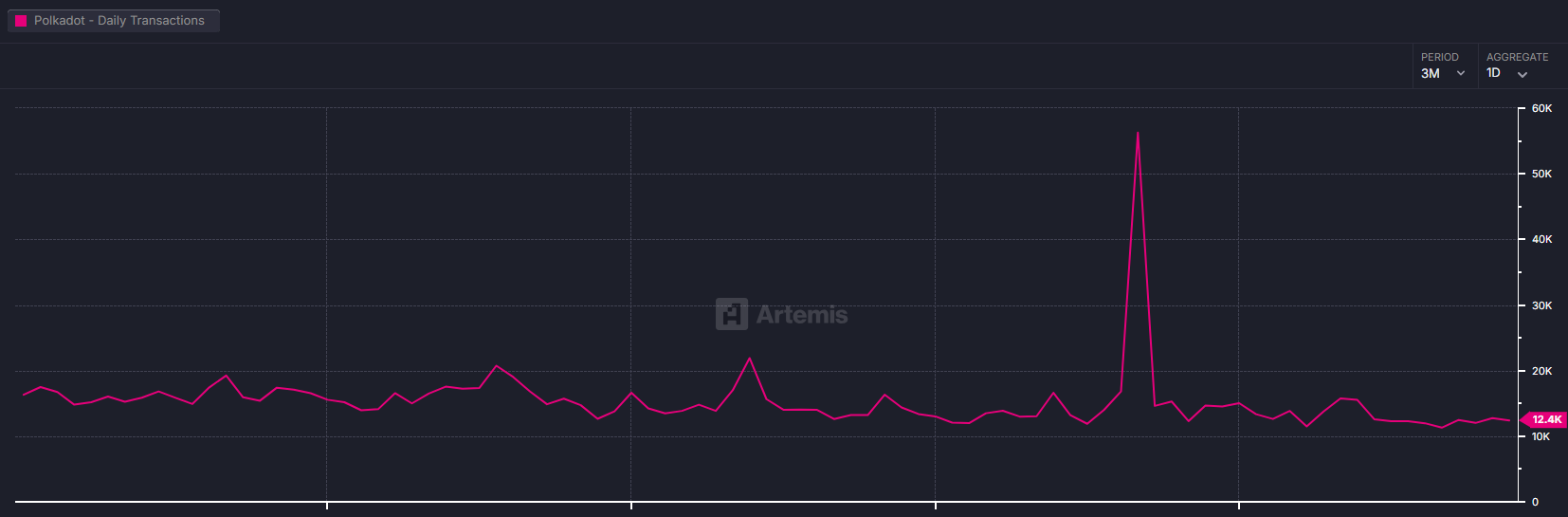

Polkadot network activity reveals interesting developments alongside technical data. Despite the decline in DOT price from peak levels, its network activity has remained steady. Additionally, it has demonstrated a remarkable surge recently.

During mid-February, a significant surge in DOT's daily transactions crossed the 45,000 mark. Data revealed that Polkadot crypto experienced growing demand from DeFi applications and token movement activity.

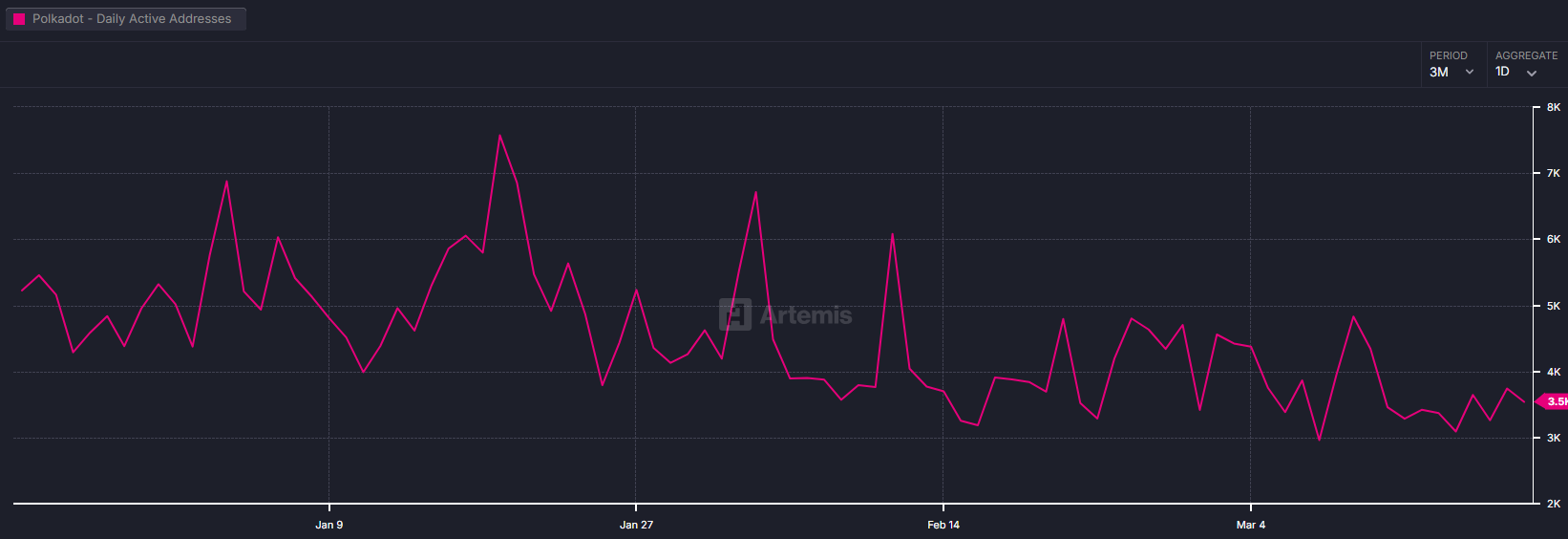

Furthermore, Polkadot’s ecosystem has seen moderate growth in active addresses compared to the past week. Amidst the price recovery, new addresses have gained interest in the token and witnessed heightened activity.

Two prominent financial organizations, Nasdaq and Grayscale Investments, support creating Polkadot ETFs in the market.

Nasdaq has applied with the US SEC to list 21Shares' spot Polkadot ETF. This ETF would allow investors to trade and track the spot DOT price without directly holding the asset.

The recent development has established significant market interest in Polkadot. The ETF filing of DOT saw a minimal price increase that spread positive sentiment throughout various market sectors.

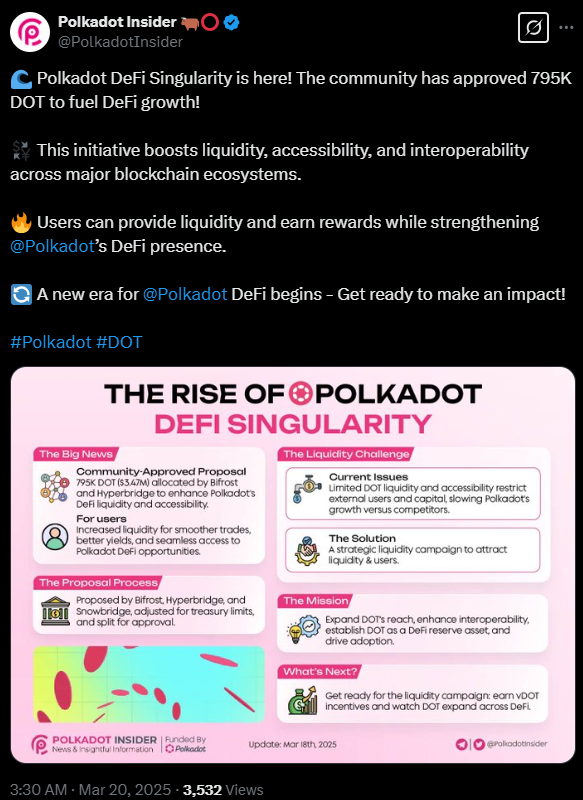

The DeFi Singularity initiative began after community support as the project received 795K DOT funds to accelerate DeFi development.

This development expands blockchain ecosystem connectivity by enabling enhanced accessibility and interoperability with the same magnitude of importance.

Polkadot Price Prediction: What's Next for DOT?

Polkadot price prediction represents a bullish outlook as the token gained bullish momentum and could see a massive rally ahead.

Polkadot’s first major resistance is around $7.00. This action is likely to create a selling wall at this level. As a result, the price action may consolidate or experience a pullback before advancing further.

If DOT price surpasses the $7.00 resistance level with robust trading volume, it could aim for the next target near $11.00. This move would indicate significant upward momentum.

However, a failure to break the $7 hurdle will invalidate the bullish thesis. Furthermore, the token might consolidate around the $4-$5 mark in the subsequent few sessions.

Disclaimer

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.