Key Highlights

- Onchain data shows demand levels in Bitcoin crypto mirror those seen after the FTX crash.

- Institutional investment in Bitcoin ETFs has surged, with inflows of $495 million over three days.

- Bitcoin price is testing the 61.8% Fibonacci retracement level at $86,146, with bullish indicators suggesting further upside.

Bitcoin price is once again on a gradual upward trajectory after the Federal Reserve’s decision to keep interest rates steady. The latest FOMC meeting revealed a slowdown in tightening measures. It hinted at potential interest rate cuts in 2025, signaling a shift in monetary policy.

BitMEX co-founder Arthur Hayes noted that these developments could bolster Bitcoin crypto’s upward momentum. However, some short-term volatility is still anticipated.

In response to this news, the leading cryptocurrency surged to a high of $87,000 during the last 24-hour trading session. It did experience a slight intraday pullback, though.

As it stands, Bitcoin price is trading at $84,360, reflecting a modest increase of 0.36% for the day. According to CoinMarketCap data, the current trend, coupled with rising institutional adoption, suggests BTC could reach the $94,000 mark in the near future.

Increasing Investor Demand Shows Similarities to Past Market Cycles

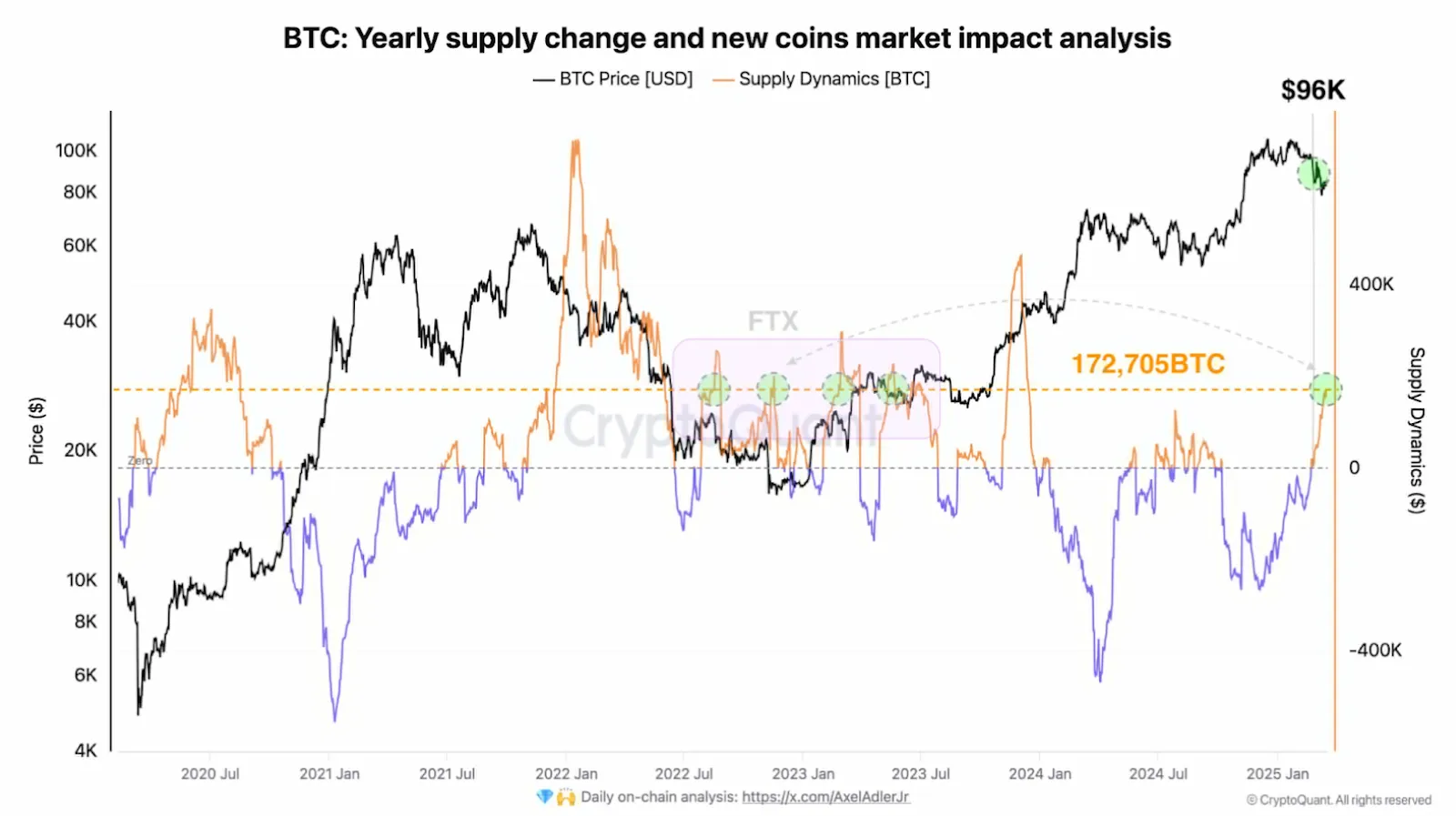

Market analyst Axel Adler Jr. notes that BTC’s current demand levels are reminiscent of those seen in the aftermath of the FTX market crash. Since February 23, investors have accumulated 172,705 BTC, indicating robust buying activity.

This level of demand has not been observed since the bullish phase following significant bear markets in Bitcoin price history.

Such strong accumulation suggests that buying pressure is likely to increase, positioning BTC price on a path toward new all-time highs. However, for this upward momentum to continue, the price must break through the local resistance trendline and maintain levels above $94,000.

Institutional Demand Fuels Market Optimism in Bitcoin Price

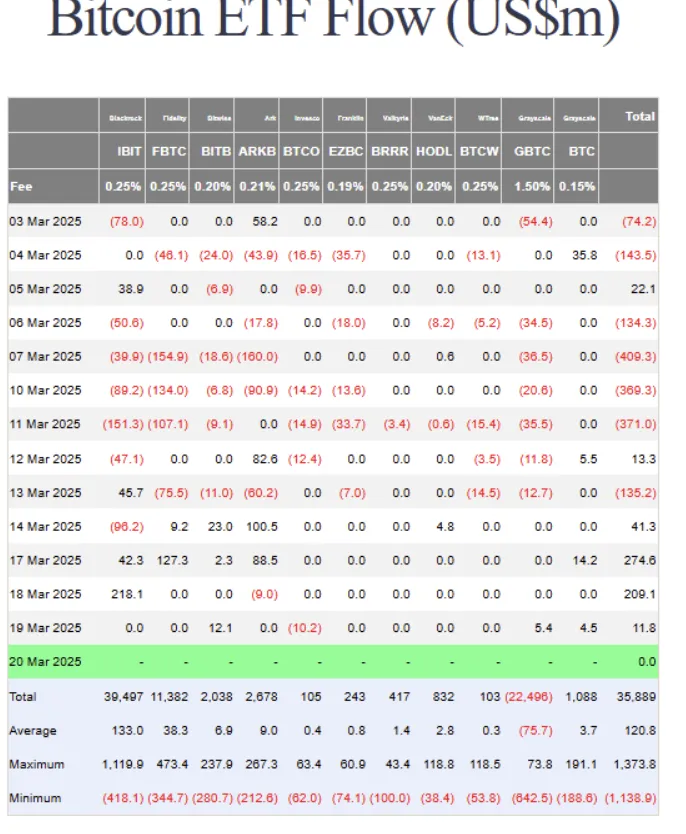

The recent increase in the Bitcoin price can be largely attributed to a surge in institutional investment in BTC spot exchange-traded funds (ETFs). Over the past three days, Bitcoin ETFs have experienced inflows totaling $495 million.

On March 19, the total net inflow reached $11.8 million, with the Grayscale Bitcoin Trust and Bitwise leading the charge. These Bitcoin ETF flows indicate that institutional investors are actively purchasing Bitcoin, reflecting growing confidence in the market.

Financial experts suggest that sustained demand for these BTC ETFs could be the catalyst that drives Bitcoin price past the critical resistance level of $94,000. A breakout above this threshold could pave the way for significant long-term gains in the weeks ahead.

Bullish Momentum Strengthens Bitcoin Price

The Bitcoin price trend shows a steady recovery from its recent low of $76,600 recorded on March 11. Over the past ten days, BTC price has risen by nearly 12%, signaling the return of a bullish squeeze trend. The daily chart indicates that Bitcoin has breached a support trendline and is currently testing resistance levels.

At present, BTC price is hovering around the 61.8% Fibonacci retracement level at $86,146. A sustained move above this level could confirm further upside potential.

Technical indicators, including the MACD and signal lines, have turned bullish, increasing the likelihood of an extended rally. However, the Stochastic RSI suggests that a short-term pullback may occur before another upward movement takes place.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Ekaterina Sokolova is known for her dynamic coverage of cryptocurrency markets and blockchain advancements. Her articles, featured in several prominent digital outlets, combine thorough research with a clear presentation style that demystifies complex technological trends for her readers.