The rise of telehealth services has reshaped the landscape of consumer healthcare in the United States, and few names encapsulate this transformation like Hims & Hers Health, Inc. Listed on the NYSE under the ticker HIMS, the company’s direct-to-consumer model aligns with a generational shift toward digital-first wellness solutions. As investors increasingly seek exposure in high-growth segments such as online health and wellness, Hims and Hers stock has become a focal point of both interest and scrutiny.

What sets Hims & Hers apart is its blend of prescription-based care, over-the-counter supplements, and personal care products delivered with a modern, accessible user experience. This distinct approach places the firm at the intersection of healthcare, e-commerce, and digital innovation—sectors primed for disruption. To truly assess the potential of Hims and Hers stock, it is essential to examine current pricing dynamics, financial performance, news catalysts, risks, and the strategic outlook driving Wall Street forecasts.

Hims and Hers Stock Price: Trends and Patterns

Share Price Performance and Volatility

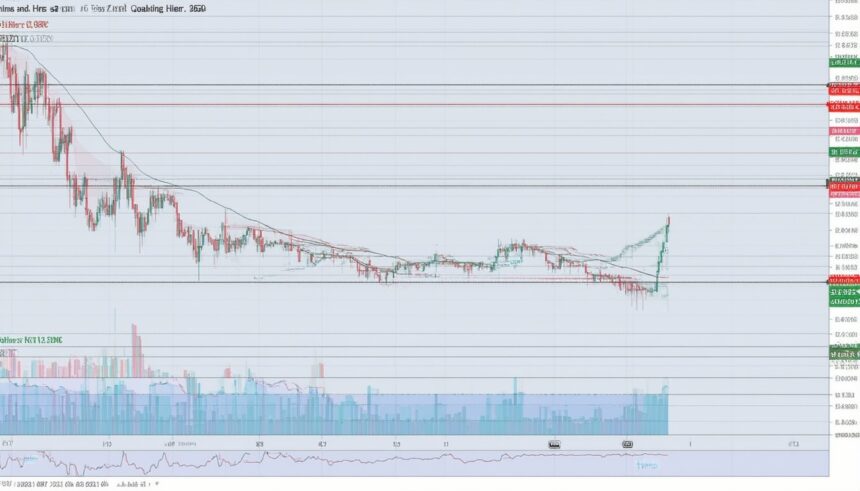

Hims and Hers stock price has experienced notable swings since the company’s public debut via a SPAC merger in early 2021. Early enthusiasm for digital health led to a strong valuation, but the broader tech stock sell-off in 2022 affected sentiment across telehealth equities. In recent quarters, however, HIMS shares have demonstrated resilience. The price trajectory often reflects not just earnings results, but broader investor sentiment toward healthcare innovation and direct-to-consumer business models.

- Historical Perspective: After peaking in the months following its market entry, the stock faced downward pressure amid macroeconomic turbulence and rising interest rates.

- Recent Recovery: A sustained uptick has accompanied positive earnings surprises and robust user growth—a trend outpacing some sector rivals.

Pricing fluctuations underscore both the opportunity and inherent volatility in high-growth, still-maturing sectors like telehealth. Investors should consider the company’s market capitalization relative to revenue and user base for deeper context.

Market Capitalization and Comparison

With a multi-billion-dollar market cap, Hims & Hers is among the top-valued pure-play telehealth firms. Yet, it trades at a premium to smaller private and public digital health startups, reflecting stronger brand visibility and a more diversified product pipeline.

"Online health platforms that achieve enduring consumer trust and recurring transactions are uniquely positioned in the public markets," observes Matthew Holt, co-chairman of Health 2.0.

Financial Performance and Key Metrics

Revenue Growth and Profitability Trends

The core narrative behind Hims and Hers’ stock is rapid, consistent revenue growth. Annual sales have climbed at impressive double-digit rates, driven by increased subscriber count and expansion of product offerings. While Hims posted net losses in its early quarters (as is typical for disruptive startups), the company has reported significant progress toward breakeven adjusted EBITDA.

Key financial indicators to monitor:

- Quarterly Revenue: Continues to deliver above-consensus top-line results.

- Gross Margin: Management has focused on scaling higher-margin segments, notably subscriptions for men’s and women’s health.

- Path to Profitability: The transition from growth-at-all-costs to prudent, profitable expansion is crucial for long-term stock stability.

Customer Acquisition and Retention

Hims & Hers boasts a growing subscriber base, with consistent increases in both net new customers and overall retention rates. Several factors underpin these metrics:

- Straightforward onboarding and telehealth consultations

- Broadening product lines—from mental health to dermatology and primary care

- Data-centric marketing driving efficient customer acquisition costs

In practice, customer engagement levels are a leading indicator of future revenue potential for telehealth brands. High repeat transaction rates suggest strong brand stickiness.

Recent News Shaping Hims and Hers Stock

Strategic Expansions and Partnerships

Recent headlines have highlighted Hims & Hers’ expansion into new medication segments, enhanced digital health platforms, and major retail partnerships. The company has also leveraged celebrity partnerships and social media-driven marketing to deepen brand recognition.

- Partnerships with Established Retailers: Collaborations with CVS and Walgreens have eased logistics and facilitated broader distribution.

- Broader Therapeutic Areas: Launches in mental health and wellness medications capitalize on rising demand for accessible care.

Such developments contribute to a bullish investor narrative, though ongoing scrutiny surrounds competition and regulatory compliance.

Industry Backdrop and Regulatory Environment

Hims & Hers operates within a tightly regulated environment. Recent FDA discussions around the remote prescribing of controlled substances, telemedicine guidelines, and data privacy laws remain watchpoints for investors. Adapting seamlessly to evolving regulations is often considered a litmus test for digital health companies' resilience.

Analyst Forecasts and Investment Thesis

Wall Street Price Targets and Sentiment

Analyst sentiment on Hims and Hers stock reveals a blend of optimism and caution:

- Bullish Catalysts: Analysts impressed by revenue growth cite the large addressable market—one that encompasses tens of millions of potential users seeking discreet, affordable healthcare solutions.

- Balanced Viewpoints: Some experts raise concerns over mounting competition from traditional providers and aggressive new entrants, as well as margin pressures in commoditized medication segments.

Price targets for HIMS often come with a wide range, reflective of both sector enthusiasm and tightening market conditions.

Growth Outlook: Opportunities and Risks

Key Growth Drivers

- Continued expansion into underpenetrated health categories (e.g., weight loss, dermatology)

- Improved operational efficiency and targeted cross-selling to existing subscribers

- Leveraging proprietary data for predictive health solutions

Key Risks

- Potential regulatory tightening affecting telehealth practices

- Escalating marketing costs in a crowded digital health landscape

- Execution challenges as product offerings diversify

Given these factors, Hims & Hers is positioned as a high-growth but higher-risk telehealth stock—a sentiment often echoed in investor circulars and equity research notes.

Real-World Scenarios: How Users Interact with Hims & Hers

User Experience and Brand Loyalty

For many consumers, Hims & Hers is more than a transactional platform—it represents a streamlined entry point into healthcare, with minimal friction and quick delivery of solutions. For example, a young professional can confidentially address hair loss using a quick online assessment and receive physician-prescribed treatment at their doorstep, bypassing traditional hurdles of in-person visits and social stigma.

This real-world convenience is pivotal to long-term user retention and the company’s compelling unit economics. On the other hand, the digital health space’s low switching costs mean ongoing innovation and excellent service are essential to maintaining momentum.

Conclusion: Navigating the Future of Hims and Hers Stock

A careful review of Hims and Hers stock reveals a company at the forefront of a rapidly digitizing healthcare landscape. Its robust revenue momentum, expanding user base, and strong brand signal staying power. However, as with all growth-stage stocks, investors should weigh short-term volatility against long-term potential, keeping an eye on evolving regulatory frameworks and escalating competition.

For those bullish on telehealth’s future, Hims & Hers offers a rare, direct avenue into this high-growth theme. Strategic patience and a keen awareness of risks versus opportunities are essential for anyone considering a stake in this dynamic segment.

FAQs

What is Hims and Hers Health, Inc.?

Hims & Hers is a publicly traded telehealth company that delivers healthcare services, prescription medications, and over-the-counter wellness products through a digital, direct-to-consumer model.

Why has Hims and Hers stock shown volatility?

The share price has been influenced by sector-wide trends in tech and healthcare, market reactions to earnings, and evolving regulatory scrutiny—all of which can cause significant short-term swings.

How does Hims and Hers make money?

Revenue comes mainly from subscription-based telehealth services, product sales (like hair loss solutions), and expanding lines of wellness and personal care products.

What are some risks with investing in Hims and Hers stock?

Major risks include regulatory changes that impact telehealth, increasing competition from established or new healthcare brands, and the need for continuous product innovation.

Is Hims and Hers profitable yet?

While the company has made progress toward profitability, it historically operated at a net loss as it prioritized high growth; ongoing improvements in operating efficiency are a current focus.

How does Hims and Hers compare to other telehealth stocks?

Hims & Hers stands out for its consumer-first brand and recurring revenue model, but faces stiff competition from both traditional healthcare providers and emerging digital health startups.

Seasoned content creator with verifiable expertise across multiple domains. Academic background in Media Studies and certified in fact-checking methodologies. Consistently delivers well-sourced, thoroughly researched, and transparent content.