- Bitcoin dropped below $113,000, and kick-started $1.7 billion in crypto market liquidations.

- Altcoins like Ethereum, XRP, Bitcoin, and many others saw losses of 6 - 10%.

- Analysts are warning of further downside, and Bitcoin could be set to test $100,000 soon.

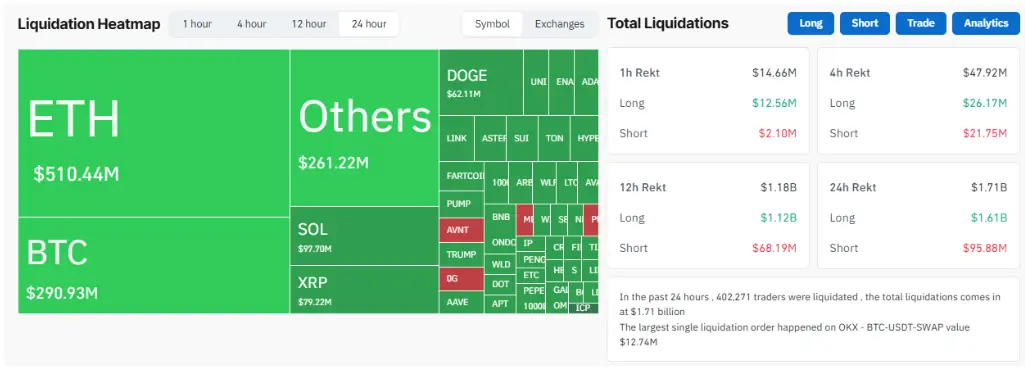

The crypto market faced heavy selling on September 22. This wave of selling wiped out thousands of traders with nearly $2 billion in liquidations.

Bitcoin led the drop and slipped under $113,000 after failing to hold resistance near $118,000.

According to CoinGlass data, more than $1.6 billion came from long positions, which shows how quickly sentiment turned bearish:

Begging the question, what could this week have in store?

Altcoins Tumble as Ethereum and Dogecoin Lead Declines

Ethereum and many other altcoins suffered steeper declines than Bitcoin. Prices fell between 7% and 10% across the board, and showed how altcoins tend to face heavier selling when the market corrects itself.

Ethereum suffered the worst of it, after losing $483 million, compared to $276 million for Bitcoin. The asset dropped under $4,200 and marked a 15% slide from its recent high.

Amid all of this, whales were reported selling holdings last week, which further added fuel to the decline.

BNB, which reached a new high of $1,088 over the weekend, slipped 4.5% amid the dip, but managed to stay above the $1,000 level. Solana dropped to $221, while XRP fell to $2.81.

Dogecoin, on the other hand, suffered the steepest percentage loss and dropped nearly 11% to $0.24. Despite the recent optimism around a spot Dogecoin ETF, the meme coin continues to trade under heavy fire.

Analysts Expect More Selling Pressure

Crypto analysts are warning traders to prepare for even more downside. For example, Ted Pillows noted that Bitcoin is facing over $2 billion worth of long liquidations around $106,000 to $108,000.

Even worse, a sweep of that range appears likely before a stronger recovery.

Captain Faibik noted bearish patterns on the Bitcoin chart. A rising wedge has already broken down, and a bearish flag is forming. He expects another leg lower that could take Bitcoin closer to $100,000.

Michael van de Poppe said that the crash was “overdue,” but urged investors not to panic because this was an accumulation opportunity.

At the same time, prediction markets are showing mixed signals. Meanwhile, some traders still expect Bitcoin to rally toward new highs once the ongoing pullback is over.

This shows an ongoing lack of conviction among investors about the market’s next move.

Economic Events Add to Market Jitters

The sell-off also happened during a busy week for the US in terms of economics. Fed Chair Jerome Powell is set to speak in the next few days, and his tone could strongly affect investor confidence.

Last week, the Fed cut rates by 25 basis points and created discussions about future policy moves.

So far, upcoming data releases include GDP revisions, housing market updates and inflation readings.

Friday’s Core PCE index (the Fed’s preferred inflation measure) may prove to be most important. Consumer sentiment reports will also show how households view the economy.

However, equity markets continue to hold strong with all three major US stock indices hitting new highs last week.

Optimism about rate cuts and progress in US-China trade talks has supported risk assets. Still, crypto tends to react more strongly to changes in liquidity.

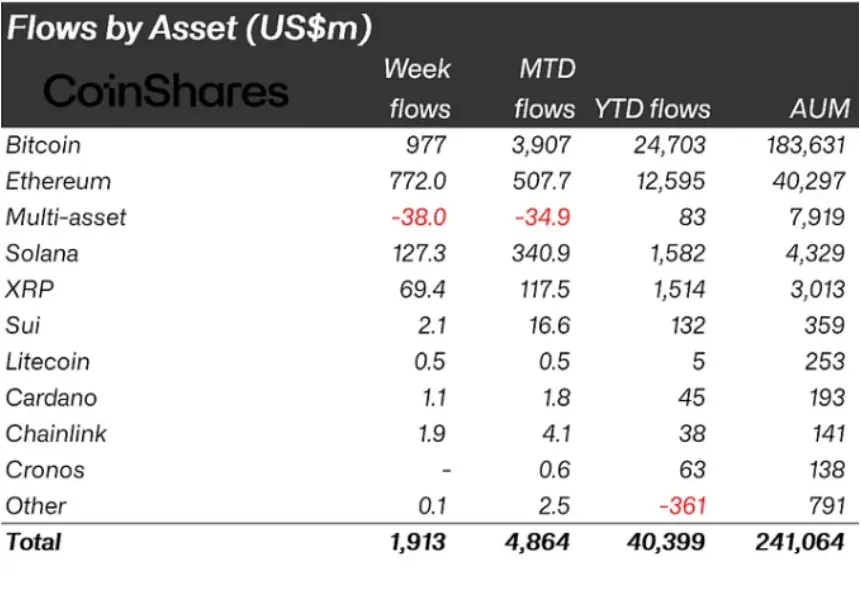

Capital Flows Show Bitcoin Still Dominates

Despite the downturn, digital asset funds attracted $1.9 billion in inflows last week, according to CoinShares.

Bitcoin captured the largest share with $977 million, and extended its streak of weekly inflows. So far in September, Bitcoin products have drawn nearly $4 billion.

Ethereum also saw strong demand and pulled in $772 million. That pushed assets under management in ETH products to $40.3 billion, which is a new record.

Solana and XRP joined the trend, and each broke above $1.5 billion in inflows this year.

These inflows indicate that while short-term trading is volatile, institutional appetite for digital assets could still be intact.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.