Key Insights

- Dogecoin price has just swung over the last day, 5.7% as traders watch the $0.25 target.

- Whale accumulation has risen lately and is mirroring the 2021 levels of activity.

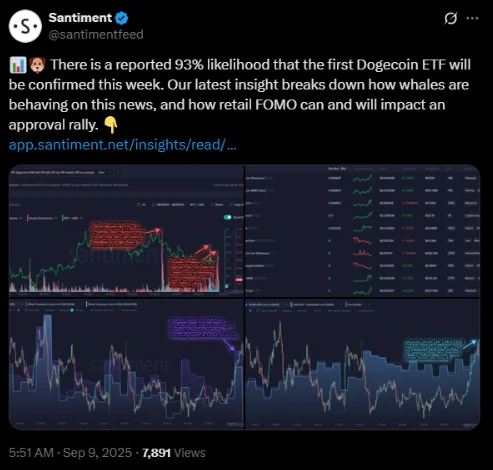

- Analysts now expect a 93% chance of Dogecoin ETF approval this week.

Dogecoin price action has been through some ups and downs this week. Traders have had to battle between profit-taking and renewed buying pressure.

So far, DOGE has traded in a 5.7% range. It even climbed to $0.244 before selling, which dragged it back to a close of $0.236. Support showed up between $0.234 and $0.237. Also, institutional desks stepped in to accumulate at lower levels.

Whale Activity and Dogecoin Price Outlook

Trading volumes were heavy and peaked at around 463.5 million tokens. This happened just as resistance at $0.244 proved too strong for the bulls to break.

Over the final hours of Monday, however, Dogecoin price recovered by 1.3% to reach $0.237. Analysts say this late-session rebound indicates a possible change in short-term price action.

Whale behaviour has also been one of the highlights of recent DOGE price action. Wallets holding between 1 million and 10 million DOGE now control 10.91 billion tokens. It is equal to 7.23% of the supply. Notably, this is the highest concentration since late 2021.

On-chain data also indicates a surge in large transfers. 118 whale transactions above $1 million were recorded in a single day. Interestingly, the last time this activity was seen was nearly a month ago.

Historically, this accumulation during dips suggests that these large players are planting their feet ahead of any ETF-related news.

ETF Speculation Fuels Dogecoin Price

The biggest story around Dogecoin right now is speculation about a U.S.-listed Dogecoin ETF. REX Shares and Osprey Funds have submitted a proposal for the $DOGE exchange-traded fund. This would be the first of its kind for the meme coin.

According to analysts at Santiment, there is currently a 93% chance of approval this week. If Dogecoin is approved for an ETF, it could mark a major milestone in crypto investing.

Traditional investors would gain exposure to the Dogecoin price through a regulated financial product. This could boost mainstream adoption by removing the need for direct token purchases.

The firms are pursuing approval under the Investment Company Act of 1940. It is known as the “40 Act.” This route has already been used successfully for a Solana ETF. This attracted $195 million in inflows.

So far, supporters believe his shortcut may help DOGE win faster approval than previous crypto fund attempts.

Technical Levels Traders Are Watching

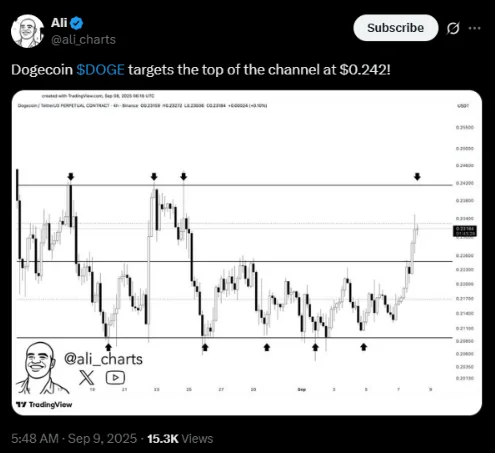

Despite the rising excitement, Dogecoin price still faces a few technical barriers. For example, Resistance at $0.244 has capped upside strength multiple times.

Because of this, analysts believe a clear break above that level could open the path toward $0.250. Ahead of this, targets at $0.260 and $0.270 are expected to come into play.

Per analyst Ali Martinez, DOGE targets the top of a parallel channel it trades in, at around $0.242. There are still a few risks, though. The downside has support at around $0.237 and then $0.225. A failure to hold $0.234 could see a retest of the $0.231 base.

The 14-day RSI currently sits above 71, indicating an overheated asset. Short-term consolidation may be needed before another strong push higher.

What Comes Next for Dogecoin Price

Traders are watching whether Dogecoin price can hold its close above $0.240 and break the $0.244 resistance. If the momentum continues and ETF approval is granted, the meme coin could quickly push toward $0.25 and beyond.

The combination of whale accumulation, trading volumes, and ETF speculation has created a charged atmosphere for the asset. Whether this translates into a lasting rally will depend on regulatory confirmation and the market’s reaction.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.