Key Insights

- After a recent bearish chart crossover, Stellar’s XLM price is now struggling near the $0.40 support.

- Market sentiment has turned negative and is adding weight to the current decline.

- New partnerships with Archax and Paxos may help Stellar recover soon if support is available.

Stellar is facing one of its most challenging periods. Its native token, XLM, is approaching a significant support level. XLM price has slipped over the last few days.

Also, the technical signals indicate that the bearish momentum might continue. Market sentiment has been weakening, and traders are now watching to see if Stellar can defend the $0.40 zone.

Despite the selling pressure, developments with the XLM chain could provide reason for a comeback soon.

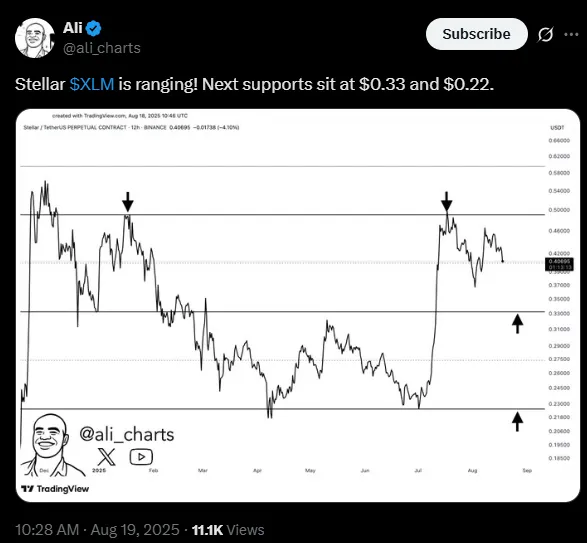

Technical Outlook for Stellar and XLM Price

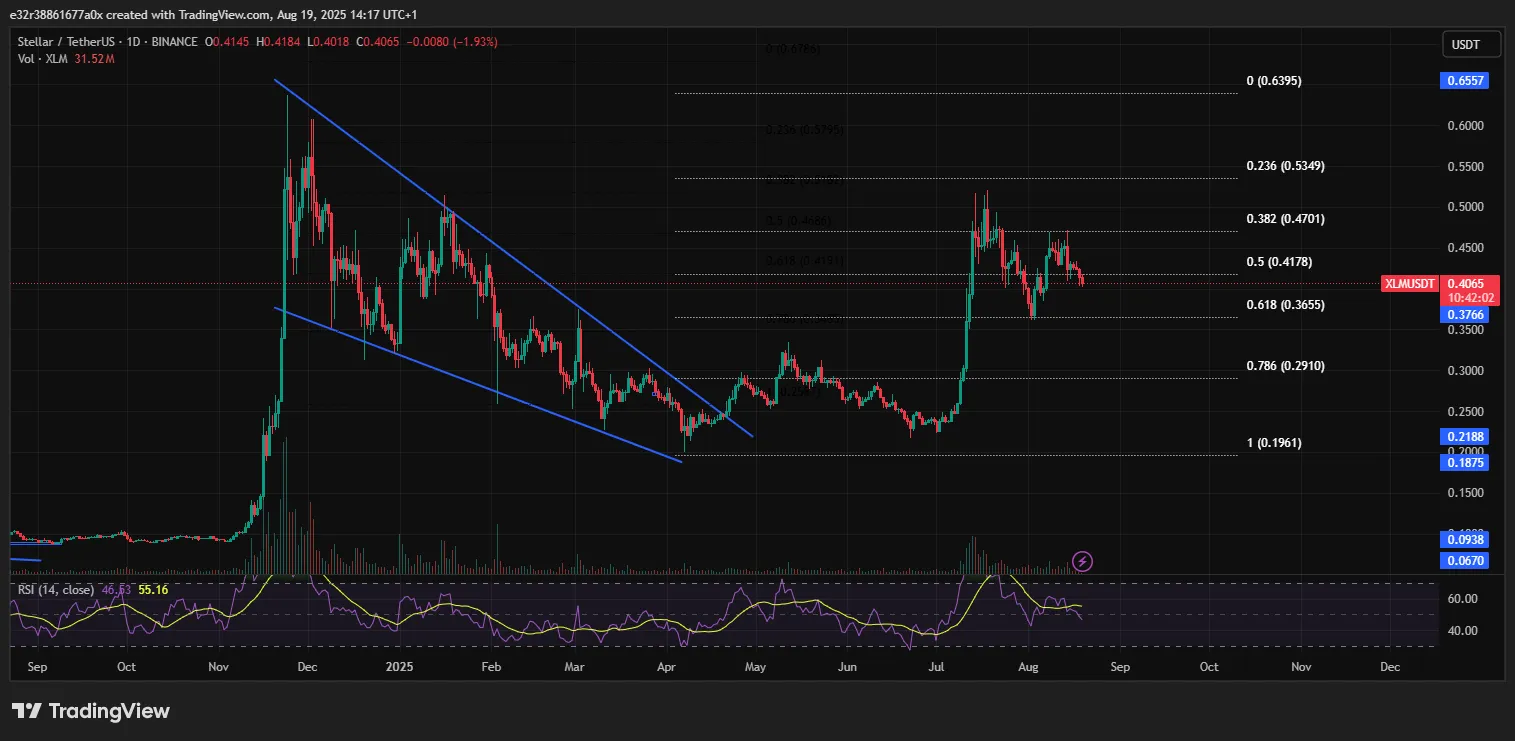

The technical picture for Stellar has become heavy, especially after a recent bearish crossover on the MACD indicator. On July 24, the MACD line crossed below the signal line on the daily charts.

Historically, this is a sign that momentum is weakening. Since then, the XLM price has traded between the $0.41 support and $0.44 resistance.

When writing, Stellar traded at $0.4062. It holds above its 50-day Exponential Moving Average (EMA) at $0.3936. However, if a break below this level occurs, the asset could test the 100-day EMA near $0.3568.

Renowned analyst Ali Martinez further confirmed this outlook. He pointed out that the next supports currently sit at $0.33 and $0.22 for the XLM price.

Momentum indicators are confirming the pressure. For example, the Relative Strength Index (RSI) has slipped to 46 and continues to trend lower. Historically, sellers have the upper hand when the reading falls below 50.

Meanwhile, the MACD continues to approach the zero line. This, if broken below, could confirm that downside momentum is stronger.

Market Sentiment Turns Negative

Technical indicators are not the only red flag for Stellar as of the time of writing. The market’s sentiment has also turned sour over the last few weeks. With this, the asset’s weighted sentiment showed a reading of -0.179.

This indicates a rise in scepticism among traders and investors. When sentiment turns negative, trading activity could decline alongside demand.

Without this renewal of buying pressure, it becomes harder for the XLM price to stage a recovery. Traders will now be watching to see if positive news can reverse the decline in confidence.

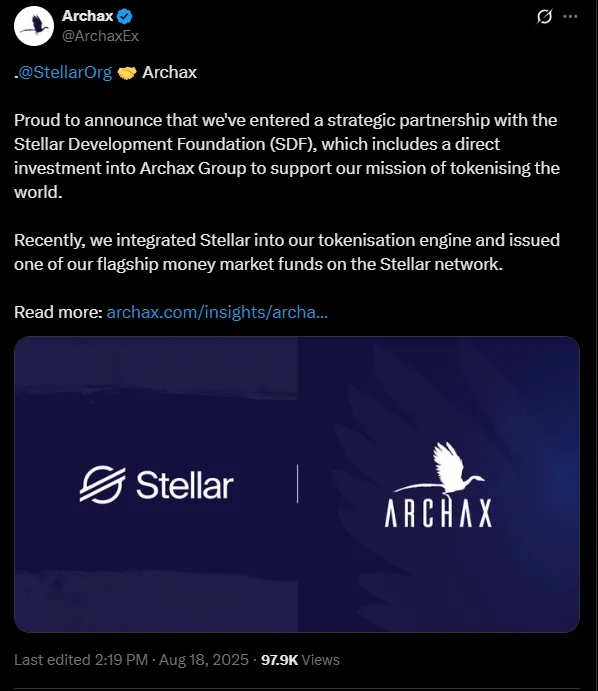

Stellar’s Partnership with Archax

While technical signals are bearish, Stellar is pushing forward with new partnerships. One of the most notable of these is its recent collaboration with Archax.

The partnership is focused on tokenising real-world assets (RWA). It aims to lower costs, increase reach, and allow instant settlement.

The Stellar Development Foundation (SDF) has also directly invested in Archax Group. However, the investment amount has not yet been disclosed.

Stellar is attempting to build a bridge between traditional finance and blockchain. It is hoping to attract more institutional interest.

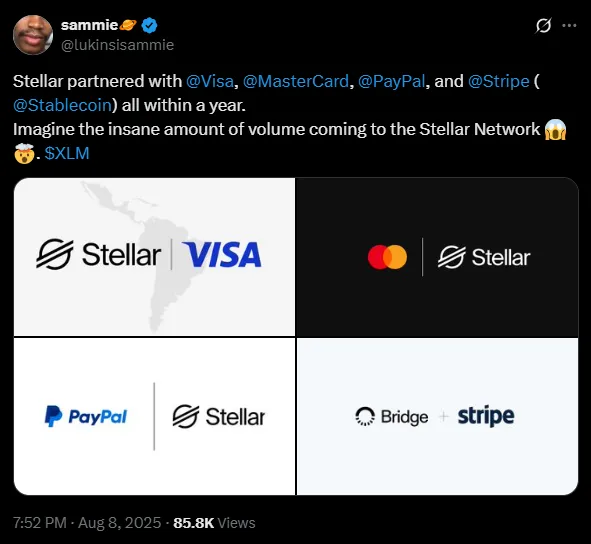

Paxos and the Launch of PayPal’s PYUSD on Stellar

Another positive development for Stellar is the involvement of Paxos. Paxos recently received a non-objection certificate from the New York State Department of Financial Services. This development now allows it to move closer to issuing PayPal’s PYUSD stablecoin on the Stellar network.

If PYUSD launches on Stellar, it could massively boost the network's liquidity and visibility. PayPal’s entry into blockchain through a stablecoin backed by Stellar would be a significant milestone for the company. It even draws in new demand for XLM.

What’s Next for Stellar?

The short-term outlook for the XLM price is currently hanging in the balance. On the downside, a failure to hold above $0.40 could open the door for a test of $0.36.

On the other hand, Stellar breaking resistance at $0.44 could open the path for a move towards $0.45. It could even go higher if the bulls do show up.

Long-term investors can take comfort in the partnerships with Archax and Paxos. They set the cryptocurrency up as one of the biggest tokenisation and digital payments players.

Short-term traders are watching the $0.40 and $0.44 levels closely. A breakout on either side could signal the next significant move for Stellar.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.