Key Insights:

- A Satoshi-era whale has moved 40,010 BTC, valued at over $4.6 billion, after 14 years of dormancy.

- This significant movement to Galaxy Digital suggests the whale may be looking to sell a substantial portion of their holdings.

- The event coincides with Bitcoin reaching new all-time highs and growing institutional interest.

A mysterious Satoshi-era whale has reawakened after 14 years of dormancy and ripped a hole through the cryptocurrency market. This primary Bitcoin holder has transferred a staggering 40,010 BTC out of their wallet and into Galaxy Digital.

Historically speaking, when whales decide to offload tokens like this, it shows an intent to sell. Analysts are closely watching this kind of activity from a long-dormant address. This is what every investor should know.

The Awakening of a Satoshi-Era Whale

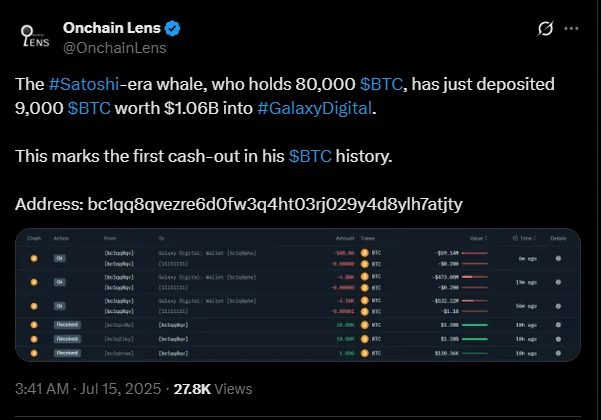

The Satoshi-era whale, which held an impressive 80,000 Bitcoin, started the transfers on Monday, July 14. Data from blockchain intelligence platform Nansen and OnChain Lens confirm that 40,010 BTC has been moved. These BTCs are worth over $4.6 Billion,

Out of this, 28,600 BTC has been transferred to Galaxy Digital. With this, an additional 10,200 BTC, worth $1.2 Billion, will be sent off again on Tuesday. This has moved the total amount to $4.6 billion in two days.

According to on-chain data, these movements strongly indicate that the whale intends to offload their long-held stash. Interestingly, this particular Satoshi-era whale has held onto their Bitcoin since 2011.

At that time, BTC was trading below $30. So far, this investor has experienced an increase of 2.4 million over the past 14 years, per TradingView data.

Market Effects and Context of Move by Satoshi-era Whale

Crypto traders often observe whale transaction patterns when making decisions. This is because these movements offer them insights into what is happening with Bitcoin on an institutional level. It also provides insights into what is happening with cryptocurrency in the short term.

According to historical activity, these large crypto holders can massively affect the market, and tend to do so sometimes. The timing of multibillion-dollar transactions by this Satoshi-era whale is exciting.

The transfers happened just a day after Bitcoin flipped Amazon's $2.3T market cap to become the world's fifth-largest asset.

While this happened, Bitcoin price recently hit a new all-time high of $122,600 on Monday. Also, at press time, it was trading around the $116,000 price level at the time of writing.

Institutional Accumulation and What The Future Holds

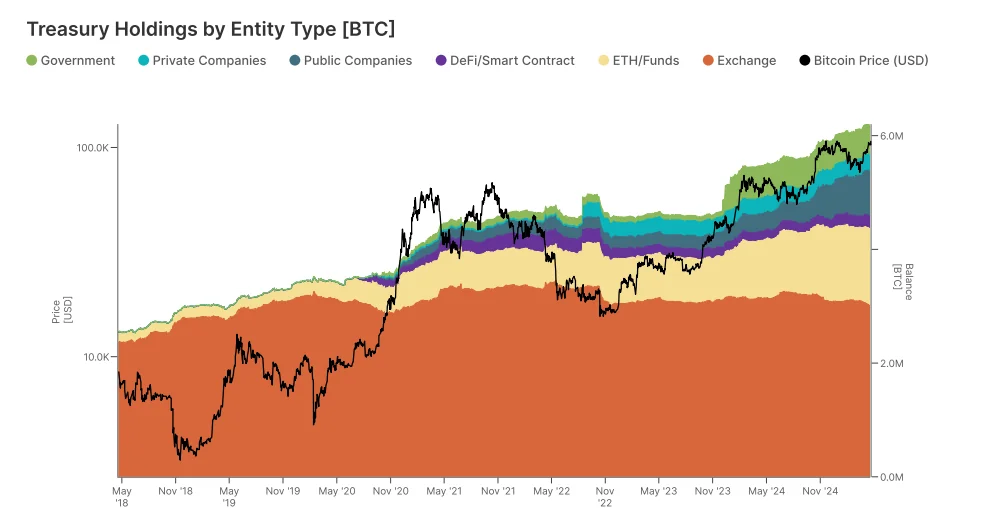

More and more long-time holders like early miners, offshore funds, and anonymous whales appear to be selling in this cycle. However, despite this, institutional accumulation has surged at the same time.

According to recent research by Gemini's Bitcoin Adoption Report, just 216 entities now control 31% of all Bitcoin in circulation. Exchanges hold the largest portion, followed by investment funds, private companies, and governments.

This shift shows a rise in institutional presence, with these entities becoming the "new Bitcoin whales." Overall, while the price of Bitcoin is currently shaky, the macroeconomic environment supports Bitcoin's long-term growth.

The increasing acceptance of the asset as a legitimate investment vehicle shows that despite challenges, the best is yet to come.

Why Does This Move Matter?

This movement of such a large amount of Bitcoin shows that holding Bitcoin is not only about profit taking. Instead, it shows that Bitcoin is maturing and increasingly regarded as a legitimate asset class.

The market must absorb these large sales as more early adopters realize they are sitting on life-changing gains. Considering Galaxy Digital’s involvement in this offload, market watchers can rest assured in the ongoing institutionalization of Bitcoin.

Bitcoin's ability to maintain its standing above the $100,000 zone shows that demand is still strong from retailers and institutional adopters.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.