Highlights

- On-chain data shows a rise in accumulation addresses, indicating investors are buying ETH at observed discounted prices.

- The MVRV ratio for ETH has dipped below 1, for a potential price rebound as it nears the average purchase price of holders.

- The ETH price is currently $2,217.58, with signs of weak bullish momentum but potential for recovery.

Ethereum price has faced significant selling pressure in 2025, the downtrend was extended in February 2025 when the ETH price broke below the 200-day EMA. The fall coincided with breach of round support at $3,000 mark.

When writing, the crypto market was struggling with external pressures, including U.S. liquidity policies and various global economic factors. These external factors led to a continued sell-off into early March, as well.

Even, the Trump administration's stance on tariffs and monetary tightening has added further uncertainty. This could impact crypto markets, including the ETH price.

Despite these challenges, ETH crypto remains the second-largest project by market cap and continues to lead in decentralized finance (DeFi) adoption.

Many analysts believe that its strong fundamentals could attract more interest from institutional buyers, with experts pointing to optimistic on-chain indicators for ETH crypto.

However, the future price direction for Ethereum may hinge on upcoming developments. The recently launched Pectra upgrade, which has just rolled out on its latest testnet, is anticipated to bring significant improvements.

With a market cap of $275.99 Billion, ETH crypto stands as a major player in the crypto space.

Market participants are keenly watching for signs of a potential price recovery as network upgrades could signal the start of a new bullish phase. Keep reading to know more.

On-chain Indicates Potential Long-term Ethereum Price Recovery

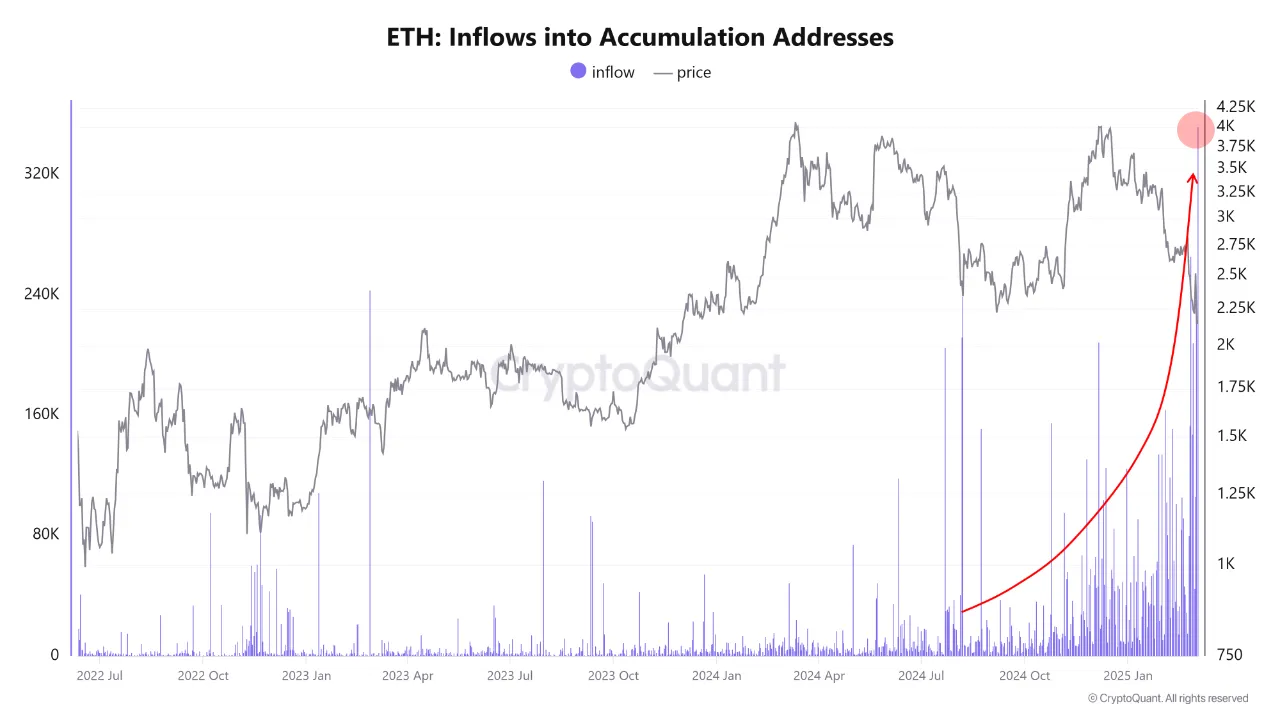

On-chain data from CryptoQuant reveals a notable increase in Ethereum accumulation addresses, as it shows that wallets that have received ETH but have never made withdrawals.

This trend indicates that investors are seizing the opportunity to accumulate ETH crypto at what they consider discounted prices in the current market environment.

If this accumulation continues, it could signal a shift in market sentiment, with institutional investors potentially gearing up for a long-term price recovery.

The rising interest in Ethereum at this juncture mirrors previous accumulation phases that preceded significant price uptrends.

Moreover, the Market Value to Realized Value (MVRV) ratio for Ethereum (ETH) has dipped below 1, suggesting that the the ETH price is nearing the average purchase price of all holders.

Historically, such conditions have been severe enough to trigger price rebounds, and past market cycles indicate that the ETH price often experiences substantial gains after reaching this level.

Furthermore, the realized price for whale investors is now heavily concentrated around the $2,200 to $2,300 range, which may serve as a strong support level.

This concentration suggests that buying pressure from institutional investors could sustain upward momentum, even if the ETH crypto temporarily dips below this threshold.

Is Ethereum Price SHowing Bullish Reversal Signs?

The Ethereum price currently stands at $2,300, reflecting a 5.62% increase in the last 24 hours, although it experienced a 9.9% decline over the past week.

Despite the bearish trend in the ETH price chart, a liquidity grab candle has formed, indicating some momentum.

However, this momentum appears weak, creating uncertainty about ETH crypto's ability to break through the $2,500 resistance level.

Many technical indicators are signaling a lack of bullish strength, leaning heavily toward bearish sentiment.

Recent analysis of the Awesome Oscillator (AO) and MACD highlights ongoing bearishness. Yet, the Chaikin Money Flow indicates rising money inflows, and the RSI has found support on the 14-SMA, remaining above oversold territory.

This suggests that, despite the dominant bearish sentiment, there may still be potential for the ETH price to rise in the near future.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Mahsa Rezaei is a forward-thinking crypto journalist based in Tehran with a strong background in computer science and finance. Specializing in blockchain technology and its impact on Iran’s economic reforms, her investigative articles and in-depth analyses are widely read by tech enthusiasts and policy makers alike.