Highlights

- A significant transaction of 95.254 million XRP worth $235.584 million was executed, indicating institutional activity.

- Active XRP addresses surged from 74,589 to 462,650, aligning with recent price increases.

- XRP is considered for inclusion in the U.S. Strategic Crypto Reserve, boosting demand and confidence.

XRP price has demonstrated impressive price movement, climbing 5.45% in the last 24 hours to reach $2.49. This surge has propelled its market capitalization to $144.21 Billion, signaling a growing confidence among investors in the asset.

Several positive factors have recently emerged, bolstering optimism around the XRP price. Many market experts are also begun increasingly voicing on further price increases.

Adding to this bullish sentiment, a whale recently accumulated $235 Million worth of XRP, which has further fueling excitement in the market alongside rising network activity. Keep reading to know further.

Analyst Highlights Giant Targets in XRP Price

Ripple's XRP price has been fluctuating within a defined range, with $2.50 serving as a crucial resistance level.

Analysts believe that if the XRP price manages to break through this resistance, it could pave the way for further gains.

Recent market developments have led to a positive outlook among analysts. One analyst, known as Steph_iscrypto, pointed out that the liquidation heat map for the XRP price suggests a potential massive short squeeze on the horizon, which could drive the price up to $4.

Another market analyst, DefendDark, has set ambitious targets for the XRP crypto price, forecasting a long-term goal of $77.70.

In the short term, he sees potential price points at $5.85 and $18.22. He further speculated that the XRP crypto’s third wave could push the price toward $18, followed by a fourth wave correction that might take it even higher to $77.70.

Giant Accumulation Along With Spike in Network Activity

Furthermore, on-chain data reveals a significant XRP transaction executed from OKX to an unknown wallet.

As this move seems like a movement typically linked to institutional activity, accumulation, or internal exchange transfers.

According to a post by Whale Alert, a total of 95.254 million XRP coins were transferred, valued at approximately $235.584 Million.

In addition, market analyst Ali noted a remarkable surge in the number of active XRP addresses, which jumped from 74,589 on February 26 to 462,650 in March.

This spike in network activity aligns with XRP's recent 5.45% price increase, bringing the token closer to a crucial resistance level at $2.50.

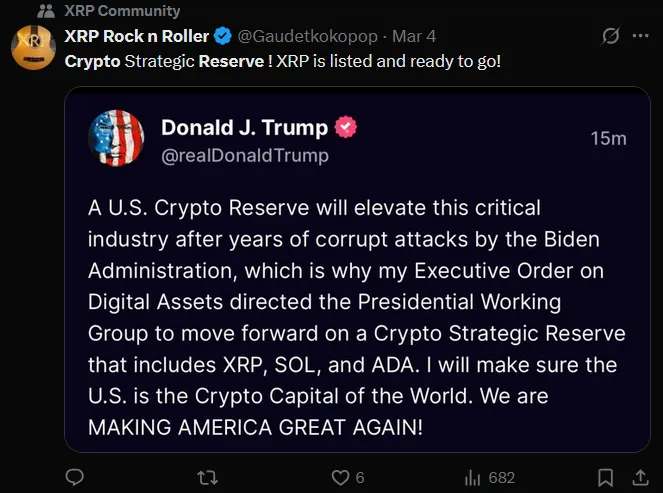

The U.S. Strategic Crypto Reserve and the ETF Factor

Also, recent developments have led analysts to believe that investors have solid reasons to be bullish on the XRP price.

Notably, Ripple’s XRP crypto is among the assets being considered for inclusion in the U.S. Strategic Crypto Reserve. Once confirmed, it could significantly boost demand and enhance the asset's value.

Moreover, this potential inclusion has bolstered market participants' confidence that the Securities and Exchange Commission (SEC) might withdraw its lawsuit against Ripple.

Another factor fueling optimism is the possibility of the SEC approving an XRP exchange-traded fund (ETF).

The regulatory body has acknowledged filings for XRP ETFs from firms like CoinShares, Bitwise, and Grayscale, further heightening expectations.

Additionally, the launch of the Ripple USD (RLUSD) stablecoin has contributed to a more optimistic outlook within the community, as it is seen as a potential catalyst for boosting the XRP price, so far.

Since its introduction three months ago, RLUSD has made a notable impact and is gaining traction in the stablecoin market.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.