Highlights

- The Bitcoin price rebounded to $89,605, reflecting a 5.18% intraday gain, as institutions buy the dip.

- Metaplanet acquired more 497 BTC, increasing its total to 2,888 BTC.

- Bitcoin exchange reserves have decreased indicating reduced selling pressure.

Over the last weekend, U.S. President Donald Trump announced plans for a crypto reserve, specifically mentioning Bitcoin alongside several altcoins.

Within hours, the Bitcoin price rose to $95,000, marking a remarkable $10,000 gain in just 12 hours.

However, this upward momentum was short-lived. The market faced renewed pressures when Trump declared a halt to military funding for Ukraine, leading to a swift reversal of the Bitcoin price gains. Consequently, the price dropped to $82,500 within a few hours.

As of now, Bitcoin exchanges are showing signs of accumulation, with some institutions taking the opportunity to buy the dip. BTC price has rebounded to $89,605, reflecting an intraday gain of nearly 5.18%.

Additionally, the month of march is shaping up to be a pivotal month, with multiple reports on the horizon.

The anticipated price movements could be significantly influenced by the release of the U.S. Consumer Price Index (CPI) inflation data scheduled for March 12 at 18:00 GMT +5:30.

Keep reading to know more for what lies ahead.

Bitcoin Price Turns Green Amid Institutional Buying

In intraday trading, the Bitcoin price is on the rise, fueled by increasing interest from both institutional investors and government entities.

Recently, President Nayib Bukele has continued to embrace BTC crypto , purchasing an additional five BTC at $83,000. As of now, El Salvador holds a total of 6,100 BTC, valued at approximately $510 Million.

Similarly, the firm Strategy, led by Michael Saylor, remains committed to aggressive Bitcoin accumulation.

The company has maintained its total reserves at 499,096 BTC, solidifying its position as the largest corporate holder of Bitcoin.

Over the past few months, Strategy has consistently made substantial and frequent purchases, reinforcing its bullish outlook on the asset.

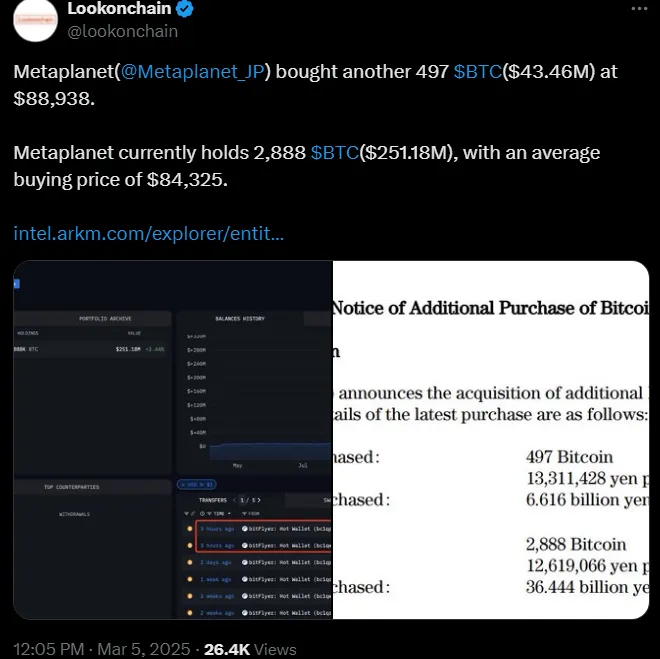

In addition, Metaplanet, a Japanese investment firm, has acquired another 497 BTC for $43.46 Million, purchasing at an average price of $88,938. This latest acquisition brings its total holdings to 2,888 BTC, valued at around $251.18 Million.

According to Lookonchain data, Metaplanet's average purchase price across all its Bitcoin holdings stands at $84,325.

This recent buy aligns with the firm’s strategy to increase its exposure to Bitcoin, highlighting the growing trend of institutional adoption in the digital asset space.

Institutions are Buying the Dips, Decline in Exchange Reserves Noted

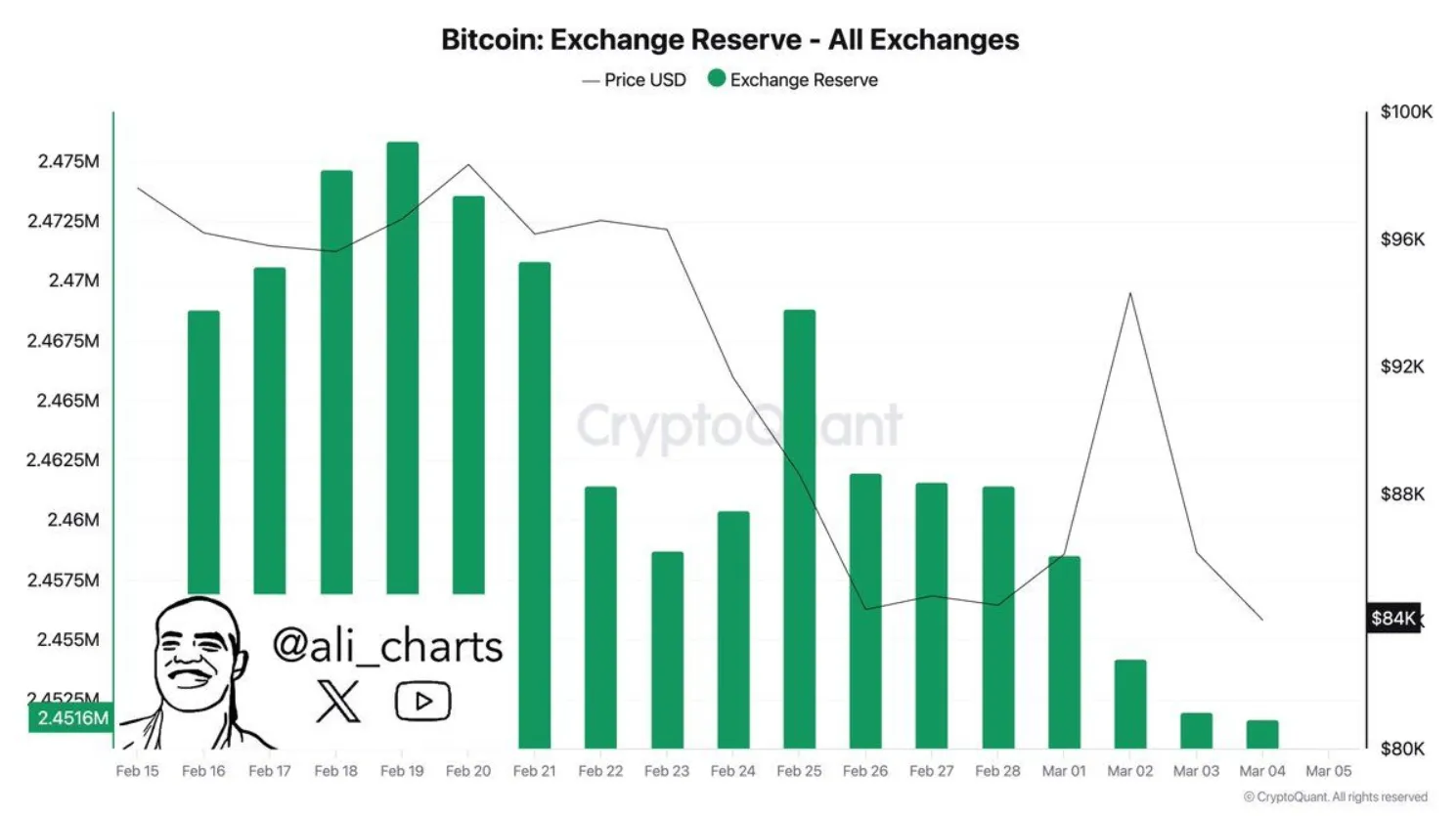

Amid the fluctuations in the Bitcoin price, there has been a notable decline in the Bitcoin exchanges reserves.

Since February 15, reserves have dropped significantly from approximately 2.475 million BTC to 2.4516 million BTC by March 5, reflecting a net outflow of about 25,000 BTC.

This decrease in reserves indicates a shift in market behavior, with more BTCs being withdrawn from Bitcoin exchanges, likely for long-term storage.

Lower exchange reserves typically suggest reduced selling pressure, which could bolster future price movements.

It’s evident that demand for BTC crypto remains robust. The combination of dwindling exchange reserves and rising demand could have a substantial impact on the market in the coming weeks.

Moreover, speculation is revolving on social media regarding President Donald Trump potentially introducing a tax plan that would benefit cryptocurrency investors in the United States.

Various sources suggest that Trump’s team is contemplating a policy to eliminate capital gains taxes on U.S.-based cryptocurrency transactions.

Crypto influencer Nick O’Neil recently shared on social media that Trump plans to unveil this development at an upcoming conference.

However, legal experts caution that such tax reform would require congressional approval. This speculative proposal regarding Bitcoin tax exemptions has reignited widespread interest in Bitcoin and other digital assets.

CryptoQuant CEO: Bitcoin Price Market Shows No Intention Towards Retail Participations

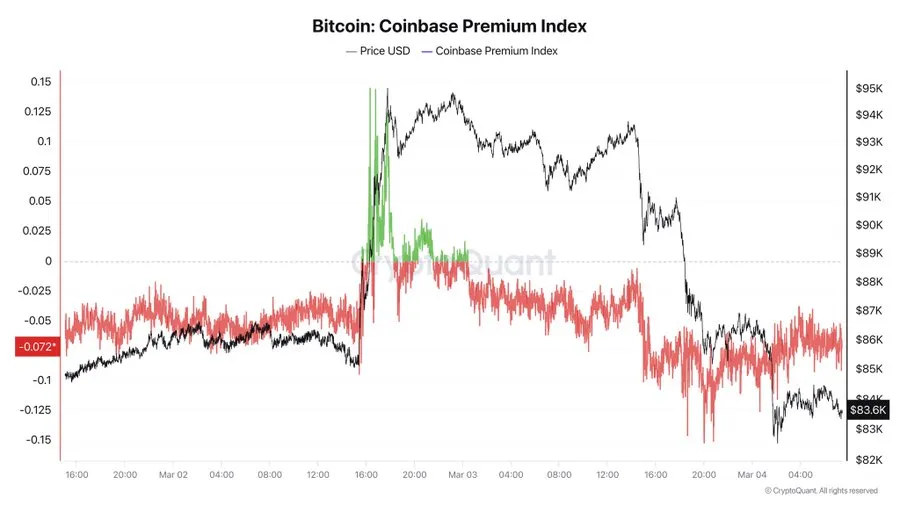

Furthermore, as it is evident on the chart that the decline in the Bitcoin price has sparked varied opinions among market analysts regarding its future movements.

Ki Young Ju, CEO and Founder of CryptoQuant, suggests that the BTC price levels are likely to maintain their current low trend until positive indicators emerge from the U.S. market.

According to Ju, while on-chain activity remains subdued, key indicators reflect a neutral stance, indicating that the bull cycle is still intact.

He also notes that the fundamental strength of BTC crypto has been bolstered by the introduction of new mining rigs. As these are expected to provide ongoing support for the market over time.

Moreover, the anticipated end of this cycle has caught major market participants, such as whales, mining companies, traditional finance institutions, and by surprise, including figures like Trump. It seems unlikely that they will let the momentum for this cycle to end so easily.

Additionally, Ju underlines that the market currently shows no inclination for retail investor participation.

Whereas, the larger market sentiments are driven mostly by large institutional players as those are exerting primary control over the Bitcoin price movements.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.