Strategy (MSTR) Stock Jumps as Bitcoin Rebounds; Traders Track Saylor’s

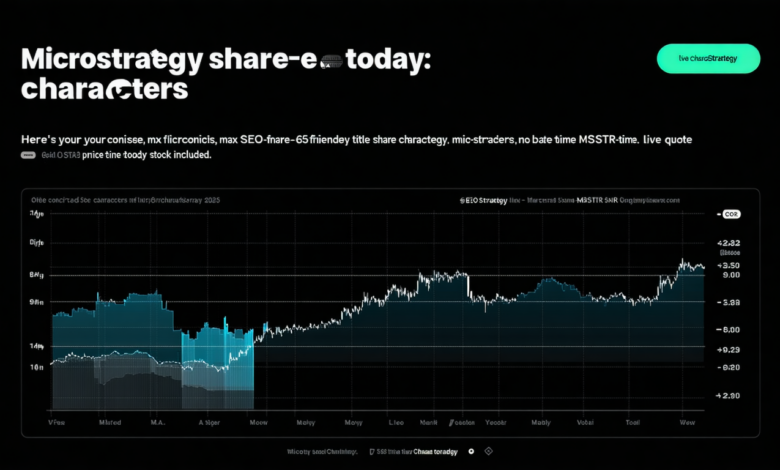

MicroStrategy—now known as Strategy Inc.—continues to attract investor attention as a uniquely leveraged proxy for Bitcoin exposure via the public markets. The current share price stands at approximately $163.11, reflecting a marginal uptick of around 0.01% from the previous close. Intraday, it traded within a range of $158.77 to $168.93, with an opening around $161.00 and trading volume just shy of 15 million shares.

This performance comes amid lingering volatility in Bitcoin markets and ongoing debates around MicroStrategy’s capital strategy—rooted in heavy BTC accumulation funded through debt and equity issuance.

Recent Performance and Market Dynamics

Stock Slump Amid Bitcoin Decline

Over the past year, MSTR shares have endured a harsh sell-off, dropping over 40–50% in line with Bitcoin’s weakness. Intense macroeconomic headwinds and Bitcoin’s heightened volatility have significantly weighed on investor sentiment.

Signs of Technical Rebound

Despite this slide, technical analysts point to a double-bottom formation around the $152 low, signaling potential bullish reversal. Some indicators—like the Relative Strength Index and Percentage Price Oscillator—also present early signs of momentum building.

Strong Institutional Positioning

Institutional confidence may be returning. Vanguard recently took a $505 million position in MSTR, signifying renewed strategic interest. Meanwhile, Benchmark reaffirmed a ‘Buy’ rating, and emphasized MSTR’s role as a benchmark Bitcoin treasury vehicle.

Risks: Dilution, Leverage, and Funding Strain

On the flip side, critics point to mounting dilution risks from frequent equity and debt issuances. As MSTR approached parity with its Bitcoin holdings, the company paused new capital raises—highlighting limitations to its funding model.Convertible debt offerings, in particular, are cited as persistent headwinds due to arbitrage-driven selling pressures.

Current Trends at a Glance

Tailwinds

- Technical uplift via possible double-bottom formation

- Institutional accumulation such as Vanguard’s entry

- Strategic reinforcement from analysts like Benchmark’s continued positive rating

Headwinds

- Liquidity and capital structure risks, including dilution from ongoing issuances

- Strong correlation to Bitcoin’s erratic behavior, magnifying volatility

- Macro and regulatory uncertainties impacting crypto-linked equities

Expert Commentary

“MSTR behaves more like a leveraged Bitcoin proxy than a traditional software firm—making it inherently risky but potent in a crypto upswing.”

This perspective echoes the sentiment that MSTR’s identity now rests heavily on BTC dynamics, not legacy software performance.

Implications for Investors

For Risk-Tolerant Investors

The setup is compelling: if Bitcoin rebounds beyond key thresholds, MSTR may see outsized gains thanks to its leveraged structure and sizeable BTC holdings.

For Conservative Investors

Caution is warranted. MSTR’s value is tethered to crypto price oscillations, complex funding structures, and dilution risk—not to predictable earnings or stable cash flows.

For Institutional Strategists

The recent institutional re-entry and analyst support suggest a “wait-and-see” posture—investors are looking for stabilization in capital discipline and Bitcoin price.

Conclusion

MicroStrategy’s share price today at around $163 underscores a story of heightened volatility, strategic positioning, and contrasting investor sentiment. Once a business intelligence mainstay, it now stands as a highly leveraged and controversial vehicle for Bitcoin exposure. While technical indicators and institutional interest hint at potential recovery, dilution risk and broader market uncertainty remain tangible headwinds.

Key Takeaways:

– MSTR offers amplified BTC exposure—but with equally amplified risks.

– Technical patterns suggest a possible turnaround—but crypto remains unstable.

– Institutional moves add credibility—yet capital structure dangers persist.

Prudent investors ought to weigh Bitcoin trajectory, capital issuance plans, and peer comparisons carefully before taking a position in MSTR.

Summary in Brief

- Live price hovers at $163, with slight intraday movement.

- Stock down significantly over the past year, mirroring Bitcoin’s fluctuations.

- Early signs of technical recovery and renewed institutional interest.

- Persistent concerns about dilution, debt leverage, and BTC dependence.