Bmnr Stock Price Price Action Explained

In the world where crypto meets traditional markets, BitMine Immersion Technologies (BMNR) stands out with its bold Ethereum-driven treasury strategy. While many companies flocked to accumulate Bitcoin, BitMine pivoted—opting to build a robust Ethereum reserve that has captured investor intrigue and driven extraordinary volatility. Let’s walk through BMNR’s current stock price, institutional moves, and strategic framework that positions it as a hybrid crypto-asset treasury and blockchain infrastructure play.

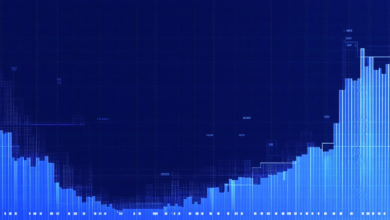

Market Pulse: Current bmnr Stock Price Snapshot

The latest price of BMNR sits at approximately $28.80, reflecting a slight intraday dip (around –0.55%) from its previous close. Intraday swings ranged between $27.96 and $29.75, with active trading volume above 28.6 million shares reported.

While earlier in January 2026, the shares hovered near $31, this earlier level had already marked a recovery from steeper declines seen in preceding months.

bmnr Price History: A Rollercoaster Fueled by Ethereum

BMNR’s trajectory has been sharply upward, then downward, in tandem with its aggressive accumulation of Ethereum:

- In July 2025, after raising $250 million, BMNR stock surged nearly 3,000% in a single week following its decision to accumulate Ethereum as a core treasury asset. The stock peaked at $136, only to see a dramatic drop in the following days.

- By September 2025, the company announced a registered direct offering at $70/share, bringing in $365 million from equity and potential $913 million from warrants—totaling nearly $1.28 billion in funding.

- Notably, this fundraising coincided with BMNR becoming the largest public Ethereum holder, with ETH holdings accounting for over 2% of circulating supply, valued in the billions.

- Moving into December 2025, BMNR further expanded its ETH stash to over 3.6 million tokens (approx. 3% of supply), acquiring another $195 million in ETH, even as the stock retreated from prior highs.

- Institutional interest remains elevated. As of early December, BMNR earned an AAII Momentum Score of 100 (very strong relative strength), though the price hovered near $31.

Institutional Sentiment and Analyst Outlook

Several indicators underscore strong institutional positioning and analyst confidence:

- As of December 2025, institutional ownership surged—funds reporting BMNR positions increased by thousands of percent, and average portfolio weight nearly doubled.

- Analyst sentiment has ranged between “Strong Buy” and “Buy,” with one-year price targets averaging from $47 to $76, implying significant upside from current levels.

This accord of institutional backing and upward-adjusted targets underscores a rare overlay of traditional finance and crypto assets within BMNR’s profile.

Strategic Depth: Using Ethereum as a Treasury Asset

BMNR’s ETH Accumulation Play

BitMine’s strategy is not incremental—it’s symbolic of a macro view taking shape:

- Ethereum as a corporate treasury reserve—not Bitcoin, but ETH, for its programmability, proof-of-stake yield potential, and dominance in stablecoin infrastructure.

- Targeting 5% of total ETH supply—a bold ambition pushed steadily by Tom Lee and institutional backers, with holdings already surpassing 3–4 million ETH, or 2–3% of supply.

- Staking infrastructure (MAVAN)—the company plans to deploy a Made-in‑America Ethereum validator network in early 2026, flipping passive holdings into active yield generation.

The Volatility Trade-off

It’s not all smooth:

- Price gyrations—the stock climbed drastically during ETH purchases, only to bleed on dilution fears and crypto volatility.

- Analyst target cuts during downturns—for instance, B. Riley reduced its fair value from $90 to $47, though it maintained a buy rating.

Expert Insight

“BitMine’s Ethereum accumulation is not just symbolic—it’s structural. Institutions are buying into a crypto-native treasury approach that doubles as staking infrastructure in a public security.”

This sums the unique thesis underlying BMNR, emphasizing that its business model thrives at the intersection of digital assets and financial innovation.

Key Takeaways and Strategic Recommendations

- Current stock levels reflect both value and volatility—while prices are subdued compared to mid‑2025 highs, they incorporate dilution risks and crypto market sentiment.

- Bullish upside remains significant—analyst targets suggest upside of 60–160%, especially if staking infrastructure (MAVAN) gains traction.

- Institutional momentum adds credibility but bears watching—rapid fund inflows lend confidence, yet could turn if crypto sentiment sours.

- Watch timelines—key milestones like the ETH validator rollout in Q1 2026 will likely be pivotal for market sentiment and price direction.

Conclusion

BitMine Immersion Technologies has taken a radically different path in the crypto-mining space, anchoring itself within the Ethereum ecosystem as a treasury-heavy, staking-ready public company. While its stock embodies volatility, it also captures a compelling growth narrative shaped by institutional demand, ambitious accumulation targets, and upcoming infrastructure deployment.

For investors attuned to crypto-linked equities, BMNR offers both risk and potential reward. Its future hinges on whether Ethereum’s broader adoption and its staking rollout can deliver on the promise embedded in its ambitious strategic blueprint.