Brown & Brown, Inc. (NYSE: BRO) stands as a formidable name in the insurance brokerage world. With a legacy exceeding 80 years, this Florida-based firm has evolved from a regional agency to one of the largest insurance intermediaries in the United States, boasting a broad network and diverse range of offerings. As the insurance landscape continually shifts with technological advancements and regulatory changes, investors have increasingly turned their gaze to Brown and Brown stock as an indicator of resilience and adaptive performance in the financial sector.

The significance of Brown & Brown’s stock performance extends beyond just numbers. It represents the stability and long-term growth potential of insurance brokerages within a highly competitive market. Delving into the price history, financial metrics, and strategic direction of Brown and Brown stock offers investors a comprehensive lens for making informed decisions.

The Business Backbone: What Drives Brown & Brown Stock

A company's stock price is ultimately a reflection of its business fundamentals. Brown & Brown’s growth story is rooted in a clear business model focused on insurance distribution, risk management, and superior customer service. With four core segments—Retail, National Programs, Wholesale Brokerage, and Services—the firm is well diversified, reducing its exposure to cyclical downturns and spreading risk across multiple market niches.

Brown & Brown’s aggressive acquisition strategy has been particularly notable. By acquiring smaller agencies and specialized brokers, the company continuously broadens its footprint. This inorganic growth model enables the firm to scale efficiently and integrate new capabilities, fueling steady revenue expansion. For example, industry reports have noted that Brown & Brown consistently executes double-digit acquisitions annually, further cementing its position in the top five U.S. insurance brokers.

Moreover, the company benefits from recurring revenues due to the nature of insurance contracts and client renewals. This business predictability is a key reason behind the growing investor confidence in Brown and Brown stock over time.

Stock Price Performance: Recent Trends and Historical Perspective

A Multi-Year Climb

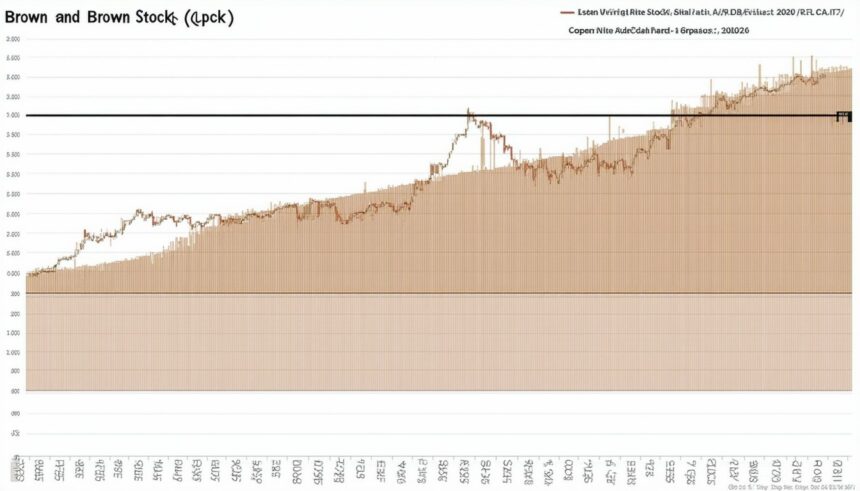

When assessing Brown and Brown stock price performance, both recent and long-term perspectives offer valuable context. Over the last decade, Brown & Brown shares have delivered robust returns, outpacing many peers and major stock indices. This upward trajectory mirrors broader industry dynamics favoring insurers and brokers, as well as company-specific execution.

Between broader market fluctuations and economic headwinds, Brown & Brown’s stock has displayed remarkable resilience. During periods of market turmoil, such as the COVID-19 pandemic, the company’s stable earnings and quick operational pivots allowed the stock to recover swiftly, reflecting underlying business strengths.

Comparing to Industry Benchmarks

Relative to the S&P 500 and insurance-sector ETFs, Brown and Brown stock has managed to sustain above-average returns. Analysts attribute this trend to its combination of organic growth, strategic acquisitions, and disciplined expense management. For investors, this consistency signals a blend of growth and defensiveness seldom seen in the broader financial services sector.

Financials and Valuation: Dissecting the Numbers

Revenue and Profit Growth

Brown & Brown’s financial reports outline a trajectory of steady top- and bottom-line expansion. The company consistently posts annual revenue growth in the high single to low double-digit percentage range. Net income margins also remain healthy, a testament to operational efficiency and prudent underwriting standards.

A closer look at cash flows reveals another attractive dimension for the stock. Strong operating cash flows—bolstered by recurring commission income—support Brown & Brown’s ongoing acquisition strategy as well as modest dividend payments to shareholders.

Valuation Metrics and Market Sentiment

Assessing valuation, Brown and Brown stock typically trades at a premium to peers, as measured by price-to-earnings (P/E) and price-to-book (P/B) ratios. Investors appear willing to pay this premium for the company’s above-average growth rates, predictable cash flows, and disciplined capital allocation.

As insurance brokerages increasingly embrace digital transformation, market sentiment for scalable, well-managed firms like Brown & Brown remains positive. However, some analysts urge caution, citing macroeconomic uncertainties and regulatory shifts that could impact near-term results.

"Brown & Brown’s acquisition-driven growth, combined with its strong balance sheet, positions it uniquely among insurance brokers. Investors continue to reward this stability and performance with a valuation premium, but ongoing discipline will be key as the industry evolves."

— Financial analyst, insurance sector

Business Strategy: Acquisitions, Technology, and Industry Trends

Mergers & Acquisitions as a Growth Driver

Brown & Brown’s M&A activity is central to its growth narrative. The company’s ability to identify, negotiate, and integrate acquisitions has been crucial in expanding market share and service offerings. By focusing on bolt-on acquisitions that complement existing capabilities, Brown & Brown minimizes integration risk while leveraging acquired expertise.

Embracing Digital Tools

Digital transformation is reshaping the insurance industry, and Brown & Brown is not standing still. From advanced data analytics to client-facing digital platforms, the firm has made sizable investments in technology aimed at enhancing both client service and operational efficiency.

Adapting to Regulatory and Economic Shifts

The complexity of insurance regulation, coupled with changes in economic climate, means adaptability is essential. Brown & Brown’s broad product portfolio and diversified business model offer buffers against these challenges. The company is well positioned to capture opportunities from both organic growth and sector consolidation, especially as smaller agencies seek partners with broader capabilities.

Risks and Considerations for Brown & Brown Investors

While Brown and Brown stock has outperformed on several fronts, it is not without risks. Market volatility, changes in interest rates, and regulatory developments all pose potential headwinds. The competitive landscape can also shift quickly, especially with new entrants leveraging technology to disrupt traditional insurance models.

Investors should monitor several key factors:

- The pace and integration success of future acquisitions.

- Reactions to regulatory changes, especially those related to insurance pricing and disclosures.

- The broader economic environment and its potential effect on commercial and personal insurance demand.

Diligence and diversification remain prudent strategies as part of any position in Brown & Brown.

Conclusion: The Outlook for Brown & Brown Stock

Brown & Brown, Inc. exemplifies what a disciplined, growth-oriented financial services company can achieve in a dynamic market. Solid fundamentals, a consistent acquisition strategy, prudent financial management, and a culture of adaptability underscore the firm’s ongoing success. For long-term investors looking at the insurance brokerage sector, Brown and Brown stock offers both resilience in challenging conditions and promising upside during periods of economic expansion.

Staying attuned to industry trends, regulatory landscapes, and company-specific initiatives will help investors make informed decisions. As Brown & Brown continues to evolve, it serves as a case study in the value of strategic growth and operational excellence in insurance brokering.

FAQs

What does Brown & Brown, Inc. do?

Brown & Brown, Inc. is an insurance brokerage firm specializing in risk management, insurance, and consulting services for businesses and individuals. It operates across retail, wholesale, national programs, and service platform segments.

How has Brown and Brown stock performed compared to industry peers?

The stock has historically outperformed many competitors and benchmarks, benefiting from a combination of organic growth, acquisitions, and operational efficiency.

What are the main growth drivers for Brown & Brown?

Key growth drivers include consistent acquisitions, a diversified client base, technological investments, and a recurring revenue model from long-term insurance contracts.

Are there risks to investing in Brown and Brown stock?

Yes, risks include market volatility, changes in insurance regulation, integration challenges from acquisitions, and competition from both established firms and tech-driven newcomers.

Does Brown & Brown pay dividends?

The company offers modest dividend payments, supported by strong cash flows. Dividend yields have historically been lower than those of some peers but are complemented by steady capital appreciation.

What should investors watch for in the future with Brown & Brown?

Investors should monitor ongoing acquisition activity, technological innovation, adaptability to regulatory shifts, and changes in the economic cycle that could influence insurance demand.

Certified content specialist with 8+ years of experience in digital media and journalism. Holds a degree in Communications and regularly contributes fact-checked, well-researched articles. Committed to accuracy, transparency, and ethical content creation.