- Ethereum has reclaimed $4,000 and is showing strong bullish signs across charts.

- Solana continues its rise within an ascending channel, and analysts are eyeing a breakout above $210.

- XRP is stabilizing near $2.35 as traders watch ETF headlines and support levels.

The crypto market seems to be making an attempt at recovery once again. Bitcoin is back above the $110,000 price level and is dragging the general crypto market up with it.

The coming week is expected to be action-packed, and here are some of the biggest cryptocurrencies that analysts are watching over the next few days.

Ethereum Reclaims $4,000 as Analysts Predict Major Breakout

Ethereum has once again crossed the $4,000 mark and has been a major source of optimism among traders. The price jumped 3.6% during Monday’s early trading session in Asia and reached $4,060. That’s nearly a 10% recovery from its dip to $3,700 just a few days earlier.

Ethereum’s weekly candle closed at $3,985 on TradingView, and analysts are describing this as a strong support level. This zone dates back to December highs and has acted as a solid floor for several weeks.

Crypto analyst Rekt Capital noted that Ethereum “wicked into its multi-year downtrend” for another retest but managed to stay within range. Other analysts are also seemingly confident about its setup.

Rekt Capital says ETH wicked into its green multi-year Downtrend | Source: X

Sykodelic said, “There isn’t a single bearish thing about the ETH chart. It doesn’t get much cleaner.”

Meanwhile, Merlijn the Trader called the current pattern “the most explosive setup since 2017.”

Bollinger Bands Show Incoming Reversal

Legendary trader John Bollinger, creator of the Bollinger Bands, made a rare bullish call on Ethereum over the weekend..

Futures trader Satoshi Flipper noted that Bollinger rarely comments on crypto and hadn’t made a call on ETH for three years. “Every time he does, it marks a generational bottom,” he said.

Investor Ted Pillows sees this as a healthy sign. “Speculation has cooled. If ETH rallies from here, it could reach $5,500 to $6,000 without overheating,” he said.

Solana Price Builds Strength Within Ascending Channel

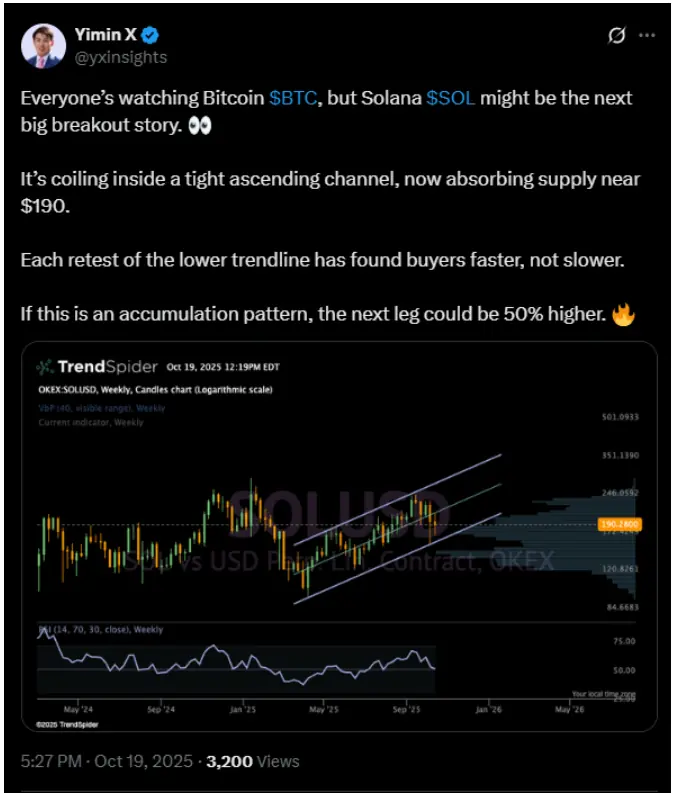

Solana continues to gain traction as it trades within an ascending channel. It is defending strongly near $190, and the price action shows that buyers are actively absorbing sell pressure each time SOL tests lower levels.

According to analyst YiminX, this accumulation pattern looks similar to those seen before previous rallies. As long as Solana holds above $180, the setup favors a continued climb.

A push past $205 to $210 could pave the way toward $246 and later $351.

The weekly structure also seems constructive with price coiling between $185 and $260. This tight range often comes before larger volatility expansions, which could soon drive the next big move.

Analysts Target $300 and Beyond

Analyst Exy believes a breakout above $260 would confirm Solana’s next leg higher, possibly to $295 and $325. As long as the token stays above its $180 base, the chart supports a bullish bias.

Short-term traders should stay alert, though. Liquidation clusters near $189 and $183 continue to create short but strong swings. Data from 5.0 Inverted shows that these zones attract heavy trading volume as leveraged positions get flushed out. Once these clusters clear, Solana may find more stable ground.

XRP Price Holds Steady Near $2.35

XRP is trading tightly after a volatile week and is holding above its short-term support near $2.34. The token’s recent range has been narrow, and it has been moving between $2.34 and $2.39.

Analysts say the current compression could come before a larger move, depending on ETF headlines expected this week.

Strategists, however, warn that XRP could still revisit $1.55 before making a structural recovery toward the $7–$27 range. Still, short-term price action continues to be neutral to bullish.

During October 18 - 19, XRP recorded a 2% trading range and is testing both sides of its narrow channel. Volume spikes indicate that buyers are defending the $2.34 area, which has acted as a base during previous pullbacks.

Traders Watch $2.40 Break for Next Move

A clean breakout above $2.40 could trigger another wave toward $2.65. On the other hand, failure to hold $2.34 might expose XRP to the $2.28–$2.31 zone.

Analysts are warning that a deeper dip to $1.55 remains possible if risk-off sentiment rises.

Macro traders are watching developments around US–China tariffs and Federal Reserve liquidity policies, which could affect risk appetite across the entire crypto market.

Despite the cautious tone, most technicians agree that XRP’s setup is still constructive. In essence, the current consolidation phase could act as a launchpad once volatility returns.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.