Key Insights

- Fed officials are now warning that the labour market weakness justifies rate cuts.

- Christopher Waller and Raphael Bostic are hinting at easing this year.

- Tariffs may push inflation higher in the short term, but are generally seen as temporary.

The prospect of Fed rate cuts is once again being debated in the US. Officials from across the Federal Reserve have shown worries about the slowing labour market and the risks it poses to the economy.

While inflation is still above target, policymakers are arguing that the weakening jobs data could justify easing borrowing costs as soon as this month.

Fed Rate Cuts and the Labour Market

Federal Reserve Governor Christopher Waller has been clear about his position. He spoke to CNBC earlier this week and called for a cut at the upcoming September Federal Open Market Committee meeting.

Waller said that the Fed needs to act early to avoid a bitter downturn in employment. He explained that labourers usually deteriorate quickly once weakness sets in.

Atlanta Fed President Raphael Bostic shares this view, according to a recent essay. Within the essay, he described the current policy as “marginally restrictive” and argued that a 25 basis point cut would be appropriate before the year ends.

Minneapolis Fed President Neel Kashkari also pointed to room for interest rates to come down over the next two years.

Inflation Pressures Complicate the Outlook

The Fed continues to target 2% inflation. While the rate has eased from 2022 highs, July’s reading held at 2.7%, which is still above the goal. Recent tariffs introduced by the Trump administration have also made the challenge more difficult.

This said, recent research from the Budget Lab at Yale shows that 61–80% of new tariffs have been passed through to consumer prices.

The Fed’s Beige Book survey also found strong cost pressures across industries, even though many firms resisted raising prices for fear of losing customers.

Waller and others believe that tariffs will only temporarily affect inflation. Once the economy absorbs the changes, they expect price pressures to settle back toward the 2% target.

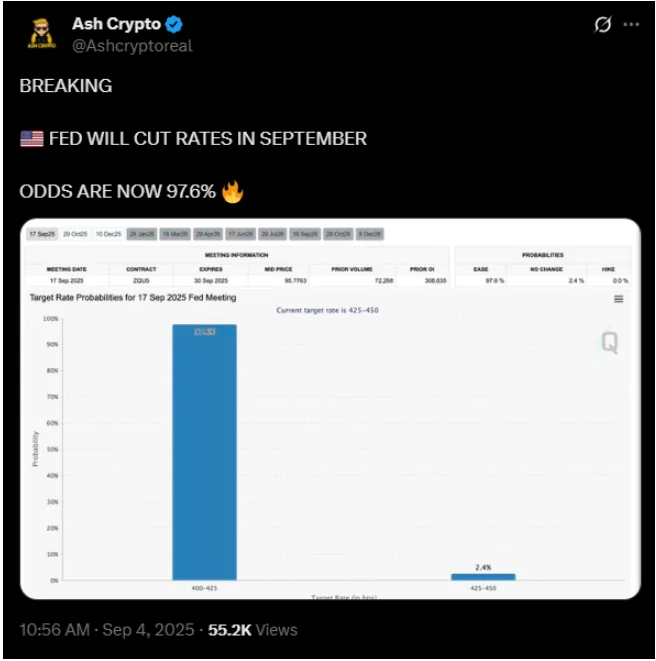

Market Bets on a September Cut

Investors are betting heavily that the Fed will deliver a rate cut at its September 16 - 17 meeting. The target range for the federal funds rate currently sits at 4.25% to 4.5%.

So far, Markets are confident in a 25 basis point reduction after Chair Jerome Powell’s recent comments at Jackson Hole.

Powell pointed out that the current outlook may require a policy adjustment, which would give traders more certainty about near-term easing. The Fed has also held rates steady through five meetings this year after three cuts late last year.

Jobs Data Adds to the Pressure

The latest government report on job openings reinforced worries about the labour market.

The Job Openings and Labour Survey, for example, showed that vacancies fell by 176,000 to 7.18 million in July. That figure was weaker than expected and shows that hiring has been slower.

St. Louis Fed President Alberto Musalem pointed out this change in an interview with Reuters. Musalem expects modest job market deterioration. However, he believes inflation will ease back toward the target by late next year.

Mortgage Rates and Consumer Impact

Mortgage rates tend to respond to the Fed’s moves, even though the central bank does not set them directly. The average 30-year fixed mortgage, for example, reached 6.56% in late August. This was lower than earlier in the year but still above historic norms.

Lenders like AmeriSave Mortgage, Quicken Loans and Rocket Mortgage now allow borrowers to lock in rates for up to 90 days. Some also offer refinancing options without extra fees when rates eventually decline.

Overall, Fed officials are currently split on how aggressively to move. However, the direction is clear. Waller has indicated that multiple cuts could follow in the next three to six months.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.