Key Insights

- A Bitcoin whale recently sold $433M worth of BTC to buy nearly 97,000 ETH.

- The wallet now holds over 800,000 ETH, which is worth around $4B.

- U.S. spot Ethereum ETFs saw $3.87B in inflows in August as more investors pile in.

A long-time Bitcoin whale has repeatedly hit the headlines after moving a massive percentage of their holdings into Ethereum. The whale sold 4,000 BTC, worth about $433 million, for 96,859 ETH in a single day over the weekend.

Blockchain analytics firm Lookonchain confirmed the transactions and noted that the whale’s Ethereum holdings are now more than 800,000 ETH.

This stash is worth around $4 billion, and most of it is staked.

Why Bitcoin Whales are Buying Ethereum

Despite the large allocation, the whale still holds over $5 billion in Bitcoin. This means that the move was more of a diversification rather than an abandonment of BTC.

Analysts have noted that Ethereum’s position as the top smart contract platform and its staking rewards make it attractive to long-term holders. Bitcoin is still viewed as digital gold, while Ethereum offers more utility and possible income.

So far, whales are recognising that digital assets are no longer just about storing value.

Ethereum ETFs and Institutional Demand

Institutional demand for Ethereum has also been increasing. August alone saw U.S. spot Ethereum ETFs rake in $3.87 billion in net inflows, according to SoSoValue. BlackRock’s ETHA ETF acquired nearly $968 million worth of ETH during the month.

At the same time, public companies like BitMine and SharpLink have added millions of ETH to their treasuries.

Moreover, data from CryptoQuant shows that ETH reserves on centralised exchanges are falling. This indicates that investors are choosing long-term storage and are easing off on the selling pressure.

This is in contrast with the Bitcoin ETFs, which saw $751 million in net outflows in the same period.

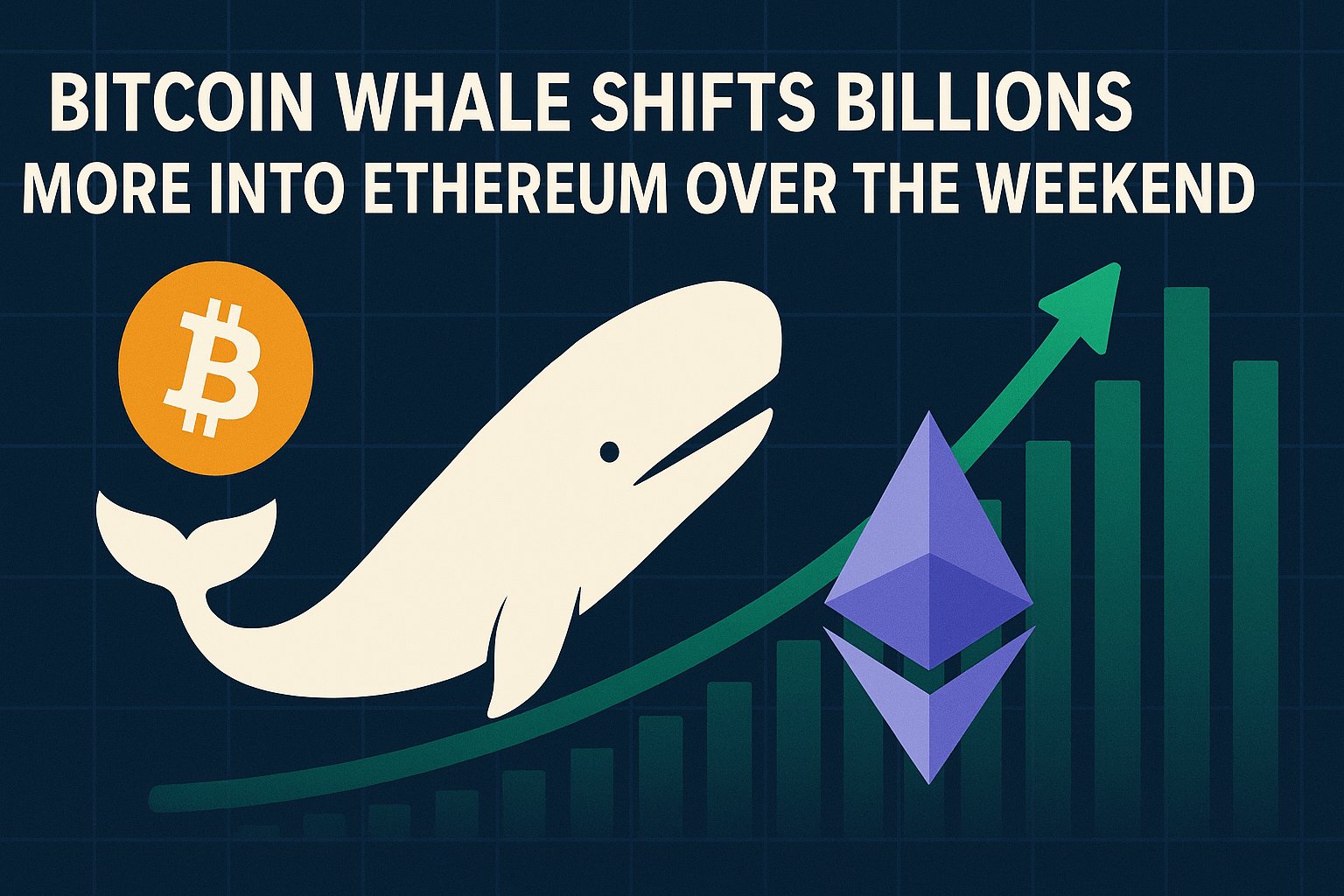

ETH Price Nears New Breakout

Ethereum’s price action shows this rise in demand. ETH hit a new all-time high of $4,946 on August 24 before cooling slightly to $4,389. Over most of the month of August, the token gained 24% despite a 7% dip in the final week.

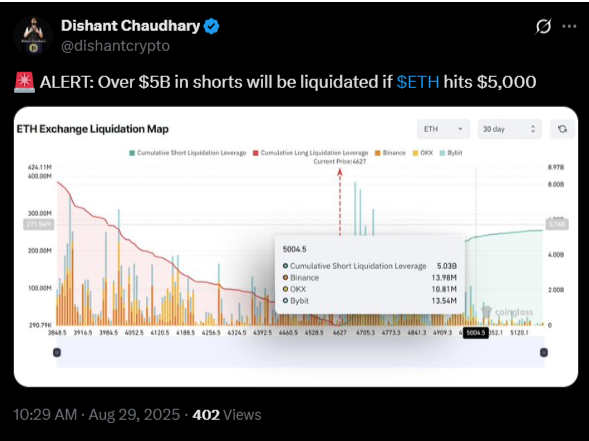

TradingView data shows that ETH closed August at its highest monthly level since December 2021. So far, analysts believe that a breakout past $5,000 could open the door to a rally toward $10,000.

Crypto analyst Patel commented that strong ETF flows and the declining exchange balances set the stage for this price jump.

Whales Keep Accumulating on Dips

Ethereum whales are not just rotating from Bitcoin; they are also actively buying dips. On-chain trackers flagged more than $1.67 billion worth of ETH bought by whale wallets during the recent market pullbacks.

These purchases were executed through custodians and OTC desks, which reduced the immediate market impact.

Together, whale wallets now control almost 22% of Ethereum’s total supply. This accumulation has helped to stabilise ETH even as the general crypto markets suffered volatility.

Ethereum is Now a Core Asset

For long-time Bitcoin holders, Ethereum is no longer just a speculative bet. The network’s staking rewards and ecosystem health have so far made it a permanent part of whale portfolios.

Ethereum ETFs and corporate treasuries have also been some of the biggest sources of adoption. Now that billions are flowing in monthly, institutions are treating ETH as a major investment.

Overall, Ethereum’s climb past $5,000 could trigger a major rally as strong ETF inflows and reduced exchange supply continue to set the stage for an upward breakout.

The Bitcoin whale’s $433 million move into Ethereum shows the general market sentiment, as both whales and institutions are increasing their ETH exposure.

All of this makes it clear that Ethereum is gaining status as more of a mainstream asset, rather than a speculative gamble.

Lately, Ethereum’s path toward $10,000 is becoming more realistic.