Key Insights

- Avalanche’s transactions jumped 66% in one week to more than 11.9 million. This comes amid announcements from the US to publish GDP figures on nine blockchains.

- Analysts say the asset could be in for a price dip towards $16.

- Meanwhile, Grayscale updated its S-1 filing to launch a spot Avalanche ETF.

Avalanche transactions have soared more than 66% in the past week to more than 11.9 million. This happened as the US government confirmed its plan to publish GDP data directly on public blockchains.

The move shows Avalanche’s rising dominance in blockchain adoption and its position among leading smart contract platforms.

Why Avalanche Adoption Is Accelerating

Data from Nansen shows the surge came from over 181,000 active wallets. This made Avalanche the fastest-growing chain in terms of transaction growth. While other blockchains also increased, Avalanche had the largest percentage gain.

AVAX has become one of the top platforms for developers, institutions, and users seeking scalable smart contracts. The rise in activity is not limited to speculative trading.

Instead, it shows a mix of stablecoin transfers, DeFi applications, and automated payments across its ecosystem. So far, Avalanche’s growth is believed to be driven by the network’s predictable costs, strong network effects, and new applications.

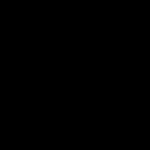

Avalanche Eyes Possible Crash Towards $16

According to analyst Ali in a recent update, Avalanche recently suffered a rejection from the $26.5 price level.

The analyst noted that the asset has been trading in a multi-month channel. Also, the rejection from $26.5 will likely lead to a possible correction towards $16.

AVAX could trek further downwards more disturbingly if the bulls fail to defend this price level. The daily charts show that Avalanche faces a possible death cross between its 200 and 100-day moving averages.

However, the RSI readings show a figure of 52.14 at press time. This indicates that the bulls have slightly more strength than the bears.

Also, if any more sudden downturns occur, the cryptocurrency could shift entirely into the hands of the bears. This being said, AVAX could trend further below the $20.95 support and indeed hit this $16 price level.

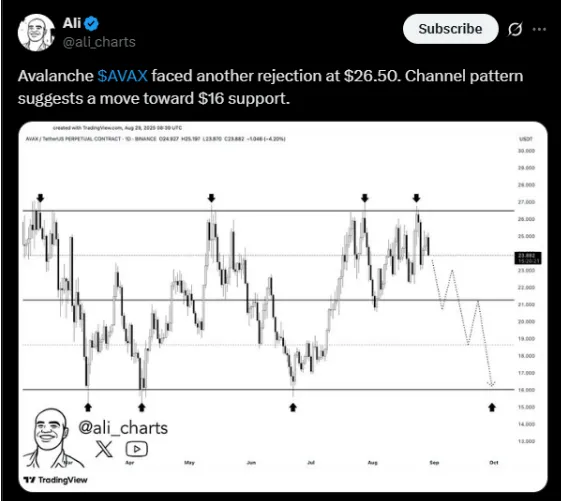

US Government Brings GDP Data to Blockchains

On the fundamental side, Avalanche has some solid backing. The US Department of Commerce recently confirmed that real GDP figures will be recorded on nine blockchains.

These chains are expected to include Avalanche, Bitcoin, Ethereum, Solana, Tron, and Polygon. The initiative is expected to make US economic data immutable and internationally accessible.

Commerce Secretary Howard Lutnick pointed out that this effort assures investors of the integrity of America’s economic data. He also called it a significant step in the right direction for transparency.

By distributing GDP reports across multiple chains, the US government creates redundancy and improves defences against data loss or tampering.

The first release of this data showed an annualised GDP growth of 3.3%. It's now permanently recorded on these networks.

Institutional Demand and the Avalanche ETF

At the same time, institutional interest in Avalanche has increased. Grayscale recently submitted an updated S-1 filing to the SEC to convert its Avalanche Trust into a spot Avalanche ETF.

The fund would trade on Nasdaq and is expected to expand access to AVAX for regulated investors. If approved, this ETF would mirror Avalanche’s price and could attract strong institutional inflows.

When combined with the rise in on-chain usage, this development could be another layer of strength to Avalanche’s adoption.

Avalanche Leads in Transaction Growth

Other blockchains also saw increased activity, but Avalanche was the leader in percentage growth. Starknet posted a 37% rise, Viction 35%. On the other hand, Coinbase’s Base network handled over 64 million transactions, the highest in raw volume.

Still, Avalanche’s 66% jump shows the chain’s ability to expand faster than its peers in relative terms. Analysts note that Avalanche’s balance of adoption and performance. Now, government recognition sets it up as a frontrunner in the next stage of blockchain development.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.