Key Insights

- The Ether Machine plans to offer institutional investors access to Ethereum yield via staking and DeFi.

- Major firms like Kraken, Pantera Capital, and Blockchain.com back this initiative.

- The company will launch with over 400,000 ETH and trade on Nasdaq under the ticker “ETHM”.

Institutional interest in Ethereum yield is heating up. Now, a new layer is set to enter the arena. The Ether Machine, a newly formed company, is going public with a staggering $1.5 billion in committed capital.

It is also doing so with over 400,000 ETH on its balance sheet. This gives investors regulated and transparent access to Ethereum yield generation.

Ether Machine Emerges as Leading Force in Ethereum Yield Strategy

The Ether Machine is not just another crypto holding company. Its branding is set up as an “Ether generation company.” It is focused on actively generating Ethereum yield through staking and advanced DeFi.

Rather than passively holding ETH, The Ether Machine will actively manage one of the largest ETH treasuries among public companies.

It has over 400,000 ETH, which is worth approximately $1.5 billion on its balance sheet. Also, it is poised to become the largest public vehicle for Ethereum yield generation.

Andrew Keys, former ConsenSys executive and co-founder of the Enterprise Ethereum Alliance, will also serve as Co-Founder and Chairman. Keys alone contributed $645M in ETH to the launch, and described the company as providing “secure, liquid access to Ether.

Backed by Crypto Powerhouses

The Ether Machine isn’t going at it alone. It has raised over $800 million from top-tier institutional investors. This includes Kraken, Blockchain.com, Electric Capital, Archetype, cyber•Fund, and Pantera Capital.

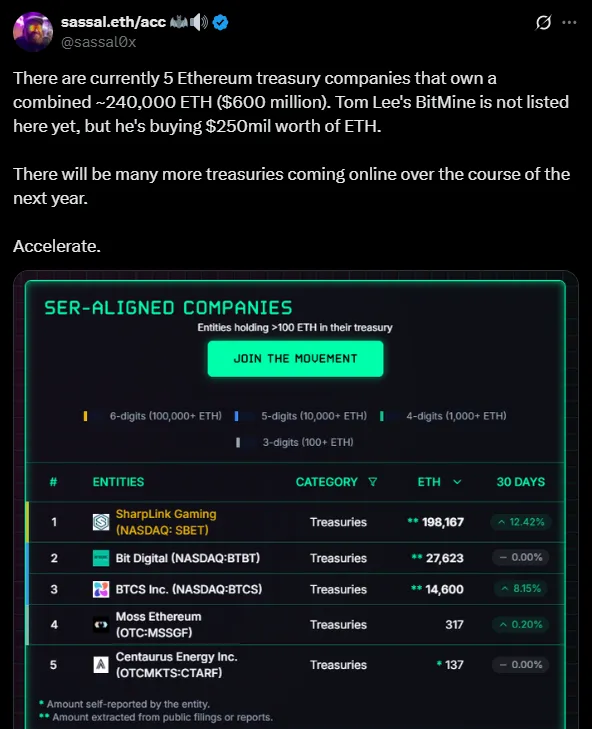

Ether Machine ETH treasury overview | Source: X

These investors are not just providing capital. They’re showing strong confidence in Ethereum's long-term potential. Its ability to provide a consistent Ethereum yield makes it an attractive investment.

This is part of a much larger trend. Like Bitcoin, these firms are beginning to include ETH on their balance sheets.

Public Launch Through Nasdaq

The Ether Machine is preparing to list publicly through a merger with Dynamix Corporation. It’s a SPAC already listed on Nasdaq under the ticker DYNX. Once the transaction closes (possibly in Q4), the new combined entity will trade under the symbol ETHM.

This public offering comes when Ethereum is gaining traction in the market, amid fresh regulatory clarity. Regarding price, ETH recently hit a six-month high, amid strong investor sentiment and the ballooning stablecoin market.

A Team of Ethereum Trailblazers

A dream team of Ethereum pioneers and finance veterans leads the Ether Machine. The first is Andrew Keys, the chairman, and David Merin, the CEO. Merin is a former ConsenSys exec and led $700M in the initiative’s fundraising and strategic deals.

Darius Przydzial will support Merin and Keys as head of Defi, and Jonathan Christodoro as Vice Chairman. Overall, this team brings both technical depth and credibility in the institutional sense.

How will the Ether Machine generate Ethereum Yield?

The Ether Machine’s business model is centered around three major pillars. It will use staking, restaking, and battle-tested DeFi protocols to generate steady Ethereum yield. All activities will follow strict risk frameworks and regulatory guidelines.

The firm will also use partnerships, research, and contributions to open-source projects. This will strengthen the Ethereum ecosystem while benefiting from its growth.

Finally, it will offer infrastructure-as-a-service. Institutions and DAOs will gain access to validator management, block-building services, and yield strategies without the need for in-house tools.

A New Era for ETH Treasury Holdings

The $1.5 billion launch of Ether Machine is part of a larger trend. Public companies are starting to hold Ethereum as a strategic treasury asset.

Michael Saylor’s MicroStrategy made headlines for doing this with Bitcoin. And now, Ethereum is stepping into the spotlight. Tom Lee’s recent $250 million ETH treasury play through Bitmine was seen as ambitious.

The rise of the Ether Machine is now more than six times greater, highlighting Ethereum’s expanding influence. This surge underscores growing trust in its role as a productive asset and a reliable source of Ethereum yield.

Reza Khosravi brings sharp analytical insight to the world of cryptocurrency. With extensive experience in technology reporting, he focuses on translating complex crypto trends into accessible content for his audience, making him a trusted voice in Iran’s evolving digital economy.