Key Insights

- ETH price bounced off from the $2000 support mark following Trump’s crypto move.

- Ethereum’s price action hints at oversold conditions, fueling rebound optimism.

Ethereum price struggled below the $2300 mark and was hovering close to the demand zone of $2000.

This week, a sharp surge over 12% to $2500 was witnessed after President Donald Trump confirmed Ethereum’s inclusion in the U.S. Crypto Strategic Reserve.

This announcement fueled market optimism and sparked speculation that ETH price displayed a run toward $3,000.

At press time, ETH price was trading at $2090, noting an intraday decline of over 11.20% in the past 24 hours. Its market cap stood at $252.09 Billion and the trading volume dropped over 12% intraday.

Ethereum Price Climb Amid News of U.S Crypto Reserve Initiative

On Sunday, Trump made headlines in the crypto space when he declared the establishment of a national Crypto Strategic Reserve that began with XRP, SOL and ADA.

However, the exclusion of Bitcoin (BTC) and Ethereum (ETH) in the first announcement triggered outrage among crypto investors.

Ethereum’s enthusiasts expressed concerns about their cryptocurrency’s absence from the national crypto reserves. In a second post, Trump outlined his position regarding Ethereum’s inclusion.

He also remarked that he loves the world’s second largest cryptocurrency, Ethereum.

However, the excitement remained short-lived, as it did with other tokens including Bitcoin, and digital assets. Afterward, Ethereum price returned to the bearish momentum and reverted below the $2300 mark.

Ethereum Price Prediction: Bullish or Bearish?

On the daily chart, Ethereum price displayed volatile swings and slipped to the make or break region, as revealed in a post by Crypto Bullet on X.

According to the analyst, ETH bulls have to defend the support zone and bounce here to remain active in the battle. Otherwise, the bear army would continue to dominate ahead and harsh decline could be seen next.

The lower low swings were exhibited on the chart and the coin’s price dropped below the key EMAs articulating the bearish sign.

However, the technical indicators revealed oversold conditions, as the RSI line stood at 33. A dead cat bounce toward $2700-$3000 could be seen ahead.

In case of a drop below the $2000 mark, ETH price might see a wild drop toward the $1800 and $1600 zones over the next few sessions.

However, a break above the $2500 mark would see a trend reversal and could ascend the rebound toward the $3000 mark in the coming sessions.

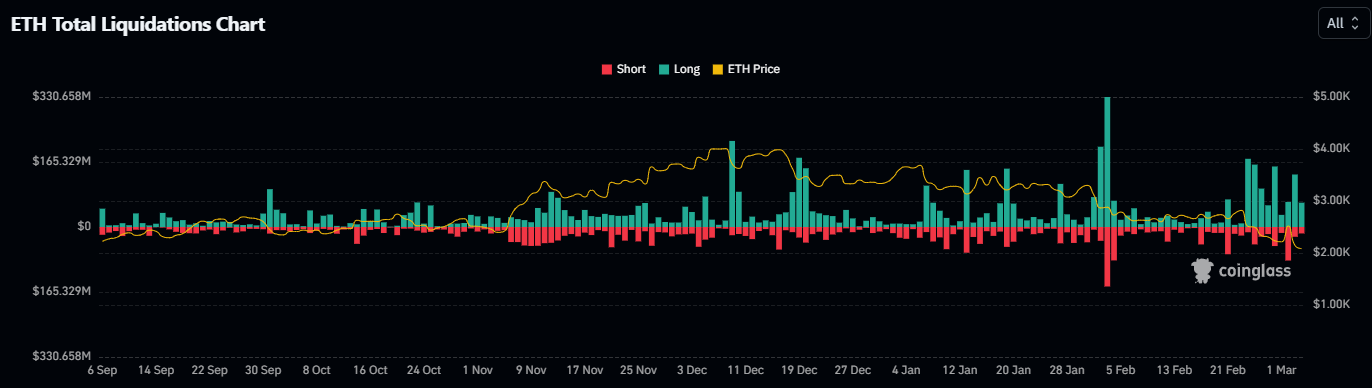

Futures Market Data Outlook

Data from Coinglass revealed massive liquidation of long positions on leveraged markets over the past 24 hours.

Over $62M ETH longs were liquidated which hints that traders have squared off their positions amid fear of losing out the gains.

Moreover, the Open Interest (OI) shed over 8.34% to $19.11 Billion, replicating a long unwinding move.

Typically, a price decline followed by a decline in Open Interest hints that bulls have lost their interest in the asset.

Furthermore, the trading volume dropped by over 17.33%, which reflects reduced trading activity over the past 24 hours.

Disclaimer

This article is for informational purposes only and provides no financial, investment, or other advice. The author or any people mentioned in this article are not responsible for any financial loss that may occur from investing in or trading. Please do your research before making any financial decisions.

Ivan Petrov is a seasoned journalist with deep insights into Russia’s dynamic crypto landscape. His work focuses on market dynamics and the transformative potential of blockchain technology, making him a go-to expert for understanding Russia’s digital financial innovations.