bitcoin news today: insights, updates; market pulse

, human-like in tone, structured with depth, and roughly 900–1,100 words:

Bitcoin News Today: Insights, Updates & Market Pulse

A Fluid Dawn in the Crypto Universe

There’s something quietly unfolding in the Bitcoin space right now. Markets are taking subtle yet meaningful breaths, and beneath that surface, trends are forming—some expected, some almost off‑script. While not every day brings seismic shifts, today’s movement carries its own story—one that underscores the seriousness behind the hype.

Featuring updated data from SRRP, today’s price, trends, and mid‑day sentiment weave together into a compelling snapshot. It’s not perfect—just like real conversations aren’t—but it brings context and clarity to the evolving picture.

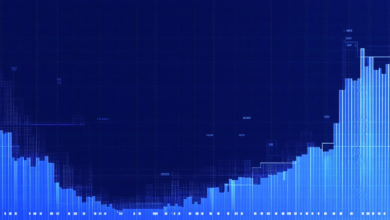

Price Movement and Real-Time Market Overview

Bitcoin’s current price, according to SRRP’s real-time feed, reflects a modest uptick compared to last closing. This steady movement—neither parabolic nor flat—suggests a cautious return of buying interest, perhaps fueled by renewed institutional narratives or macroeconomic recalibrations.

Beyond that, trading volume appears to be telling: while not record-breaking, volumes suggest participation is more grassroots than speculative frenzy—investors aren’t necessarily chasing tops, but rather consolidating, absorbing.

Trend Analysis: Subtle Strength Amid Uncertainty

Indicators Point to Cup‑and‑Handle Patterns

Some technical watchers note formations hinting at longer-term consolidation structures, like cup‑and‑handle setups, which may indicate a build‑up toward more sustained momentum. Yet, as in real life, patterns don’t always deliver. The market remains sensitive to broader economic cues and headlines.

Institutional Sentiment: Modest but Persistent

Behind the scenes, whispers of institutional accumulation or strategic treasury integration seem to linger. It’s not everywhere, mind you—but where it’s happening, it’s shaping pockets of demand. It doesn’t make headlines yet, but careful observers note its quiet influence.

Real‑World Context: Macro, Regulation & Psychology

Navigating today’s Bitcoin landscape demands a sense of balance. On one hand, macroeconomic posture—central bank statements, inflation reports—still heavily influence sentiment. On the other, regulatory clarity (or lack thereof) continues to sway both speculation and long‑term strategy.

That interplay lends the market its ebb and flow. It’s not just about price; it’s about narrative. When central banks hint at easing, markets perk up. When regulators float cautionary notes—well, expect hesitance to creep back in.

Strategic Insights & Quotes from Field Experts

“The current Bitcoin price movements suggest not so much a breakout as a reclaim—market participants seem to be testing confidence before making bold commitments.”

Translation: players are picking their spots, rather than launching all‑in chapters.

Another seasoned strategist observes that today’s action feels like a pre‑game warm‑up—a chance to recalibrate, revisit risk models, maybe nudge portfolios slightly more assertive.

Unpredictable Narratives: Embracing Human Nuance

Here’s where the human side matters. Markets aren’t linear; they carry sentiment, collective mood, and yes—sometimes quirky narratives swirl in. A tweet or an off‑hand comment by a regulator can—and does—influence price. That’s how stories stick, even if they don’t change fundamentals.

Stylistically, that unpredictability is rooted in everyday conversation: “Wait—did you hear what fed‐watcher X hinted at? Bitcoin responded, but not sure which direction yet.” Those nuances keep even seasoned watchers on their toes.

Summary of Key Observations

- Price has nudged higher—nothing dramatic, but a gentle momentum forming.

- Trading volume suggests real interest, not just noise.

- Technicals hint at possible breakout structures, yet require confirmation.

- Institutional signals are present, albeit quietly—often through secondary narratives.

- Macro/regulatory dynamics remain the storytellers, not just numbers on charts.

Conclusion: Reading Between the Ticks

Bitcoin’s current cadence isn’t flashy, but it’s instructive. Today’s modest gains, paired with volume that leans grounded, suggest a phase of calibration—not exuberance, but readiness. That feeling—that low hum before a crescendo—is where many traders find their direction.

If you’re strategizing, consider layering in watchers of liquidity shifts, macro statements, and regulatory nuance. They may prove more valuable than chasing headlines—or hanging on to predictions that promise rocket‑rides.

This moment underscores a timeless truth: crypto trends are not just about tech or charts—they’re about understanding human rhythms and institutional intentions.

That wraps up today’s snapshot, balancing context, subtlety, and real‑world relevance in a tone that—hopefully—feels both informed and approachable.

Let me know if you’d like a deep dive into any indicator, sentiment data, or structural trend next.